Genworth Financial's efforts to advance its sale to China Oceanwide hit a roadblock as bondholders did not respond to a consent solicitation for easing a possible Canadian mortgage insurance unit sale.

The Richmond, Va.-based insurance company elected to terminate the solicitation of holders of seven different debt obligations (six senior notes, one subordinate) announced on July 24 with an Aug. 9th expiration. Genworth failed to receive the consent from the majority of the holders of the aggregate $2.47 billion principal amount outstanding.

"Rather than extend the expiration date for those series, the company has determined to terminate the consent solicitation with respect to all series," it said in a press release. "Genworth intends to take alternative measures, as it deems appropriate, to ensure compliance with the indentures in connection with any potential sale of the company's interest in Genworth MI Canada Inc., which operates Genworth's Canadian mortgage insurance business."

The solicitation would have created an express authorization for the sale or other disposition, in one or more transactions, of Genworth Financial's holdings in mortgage insurance companies outside of the U.S. Specifically, it was aimed at allowing Genworth

Canadian regulators have not issued any findings in regards to the China Oceanwide transaction; as a result,

"While we are pursuing this sale in an effort to close the Oceanwide transaction as soon as possible, we believe that the sale of Genworth Canada would also allow us to reduce our outstanding indebtedness and increase our financial flexibility whether or not the Oceanwide transaction is completed," said Tom McInerney, Genworth's president and CEO, during the company's second quarter conference call.

Besides the majority holdings in the Canadian company, Genworth also owns a majority stake in a publicly-traded Australian mortgage insurer.

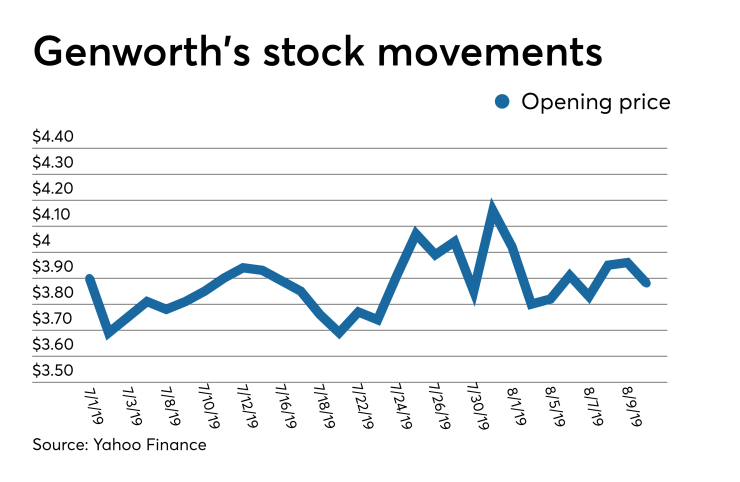

As of 11:30 a.m. on Aug. 12, Genworth's stock price was down $0.10 to $3.82 per share.