After it plateaued in

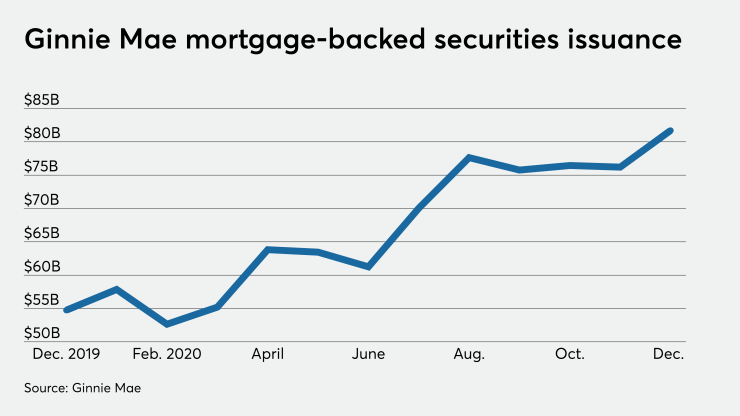

The volume of Ginnie securities issued in the last month of 2020 exceeded $81.7 billion, marking the first time more than $80 billion has been issued in a month. The

“Investors demonstrated widespread demand for Ginnie Mae securities in December and throughout 2020,” Executive Vice President Eric Blankenstein said in

Ginnie financed homes for more than 289,000 households during the month.

The government bond insurer, which is an arm of the Department of Housing and Urban Development, also recorded a record number of Platinum transactions in December 2020 at $3.5 billion. In these transactions, multiple Ginnie Mae-insured loan pools with similar rates, terms and maturities are combined into a single security.

There has been anticipation that distress related to the coronavirus would increase the overall level of repooling activity. As a result, temporary restrictions were

While monthly issuance rose to a record in December, the outstanding principal volume of Ginnie Mae MBS was essentially flat compared to a month earlier, and down slightly compared to the end of 2019.

There were $2.11 trillion in outstanding securities as of Dec. 31, 2020, roughly even with what was seen at the end of November. At the end of 2019, there were $2.118 trillion in securities outstanding.