The chief executives of Fannie Mae and Freddie Mac say limiting their growth by placing constraints on their portfolios and curbing their debt issuance would result in higher mortgage rates.In Senate testimony late Wednesday, Freddie Mac's new chairman and chief executive, Richard Syron, said there is "no way that mortgage debt and the risks of investing in it would disappear by downsizing the [government-sponsored enterprises] or making other changes to the GSE charter." Fannie Mae CEO Franklin Raines said, "Any arbitrary constraint on our portfolio would remove an important bid for mortgages from the market, which would lead to higher and more volatile mortgage rates for homeowners." The day before, Federal Reserve Board Chairman Alan Greenspan told the Senate Banking Committee that as a "goal" he favors privatizing Fannie and Freddie or limiting their growth by putting constraints on their debt issuance. The central banker said he thinks it's essential to the U.S. economy to eliminate as much as possible the two GSEs' federal subsidy and their ability to expand their on-balance-sheet assets.

-

In the highest-priced housing markets, some buyers see adjustable-rate mortgages as the only loan they may initially qualify for, Cotality found.

5h ago -

The company dropped the broker channel just months after Frank Martell became CEO; now that Anthony Hsieh is running things again, LoanDepot brought it back.

7h ago -

TransUnion cuts VantageScore 4.0 to $0.99, aiming to boost lender choice and affordability as FHFA pushes mortgage score modernization and competition.

8h ago -

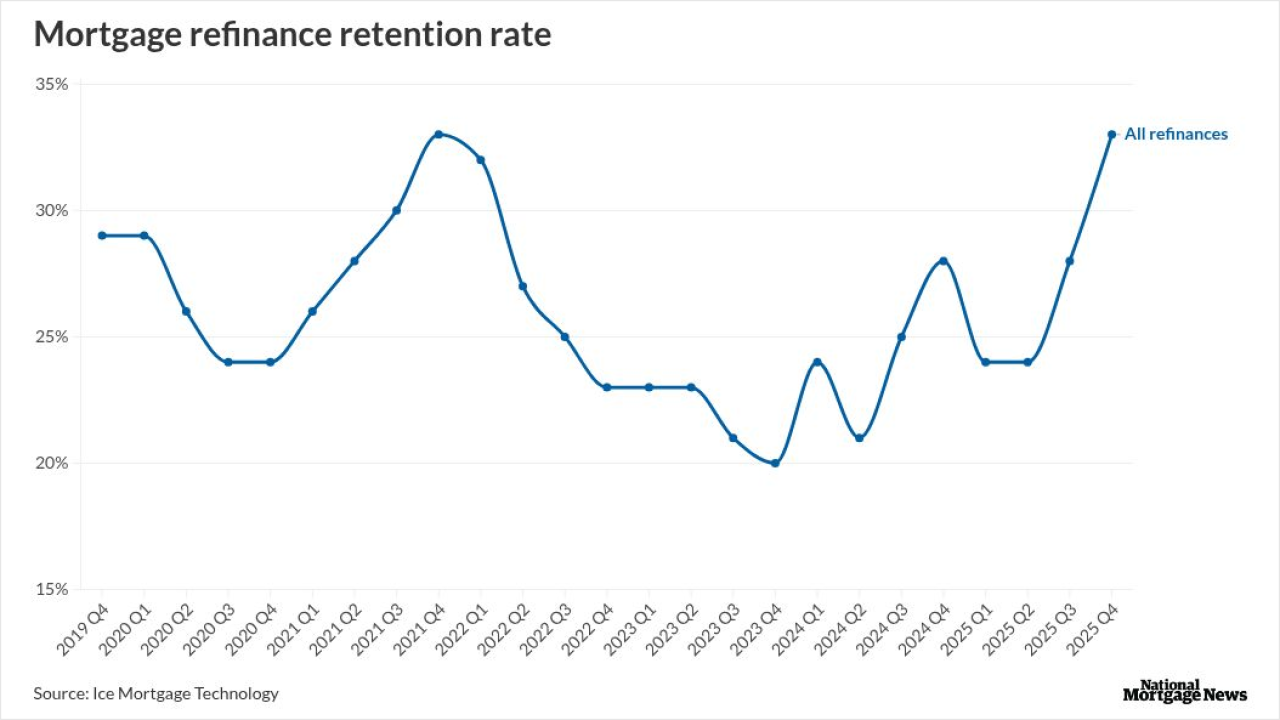

An estimated 565,000 first-lien refinances closed in the fourth quarter, up 50% from a year prior and the most since the second quarter of 2022, ICE found.

8h ago -

Borrowers or lenders could use the prediction markets as a hedging tool, although experts noted the lack of trading volume as cause for caution.

March 9 -

The industry welcomed the Department of Veterans Affairs' plan for implementing legislatively-created borrower relief but some would like more clarification.

March 6