Fannie Mae and Freddie Mac are becoming increasingly concerned that mortgage servicers will not be able to honor their obligations to repurchase bad loans. Fannie expects repurchase and reimbursement requests will remain high in 2009 and into 2010 and it already has a significant number of requests that have not been paid. "Due to the current housing and economic environment and the adverse impact on our servicers, we may be unable to recover outstanding loan repurchase and reimbursement obligations resulting from breaches of representations and warranties," Fannie says in its third-quarter financial statement. Fannie does not disclose the amount it collects from servicers. But Freddie Mac reported that its servicers have repurchased $2.7 billion in bad loans during the first three quarters of 2009, including $960 million in the third quarter. "Our exposure to seller/servicers could lead to default rates that exceed our current estimates and could cause our losses to be significantly higher than those estimated within our loan loss reserves," Freddie says in its third-quarter financial statement. Lenders that sell loans to Freddie and Fannie are required to make representations and warrantees that the loans comply with the government-sponsored enterprises' underwriting requirements. If the loans don't perform as expected and underwriting deficiencies are flagged, the lender is obligated to buyback the loan.

-

Treasury Secretary Bessent said FSOC is readjusting its approach to avoid stifling growth in moves with implications for capital, technology and mortgages.

December 11 -

ETHZilla partnered with Zippy to bring manufactured home chattel loans on-chain as tokenized real-world assets.

December 11 -

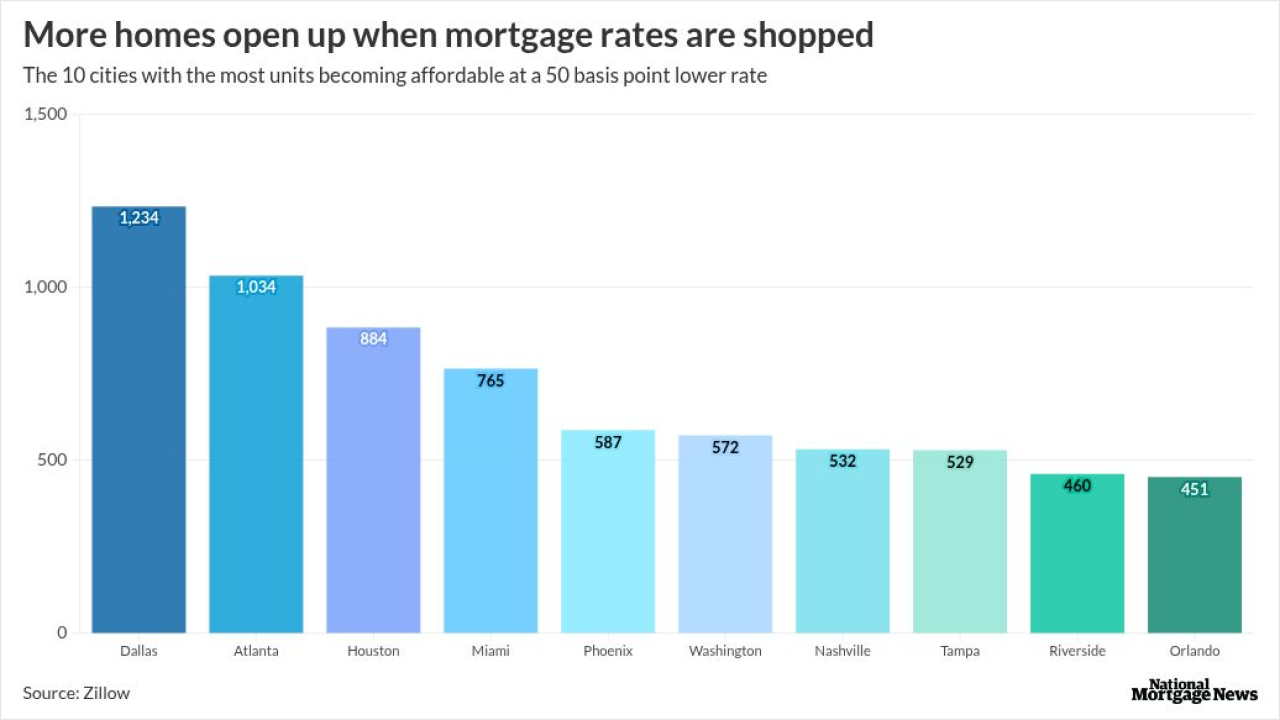

Approximately 70% of home purchasers do not get more than one quote in the mortgage process, doing so could reduce their rate by 50 basis points, Zillow said.

December 11 -

The Federal Reserve Board of Governors voted Wednesday to reappoint 11 sitting regional Fed presidents, without any dissents. The move precludes any effort the White House might have made to pressure the board to deny reappointments.

December 11 -

The rent reporting platform says it's helped tenants raise their credit scores by double digits and unlocked $30 billion more in mortgage lending.

December 11 -

The government-sponsored enterprise removed a limit on adjustable-rate mortgages, and added flexibilities for repair, manufactured home and ADU financing.

December 11