Slowing originations and slimmer margins pushed down profits at the parent company of Guild Mortgage in the fourth quarter, but its servicing segment’s earnings saw a boost.

Company management plans to take advantage of industry-wide conditions to make acquisitions during the consolidation many expect to take place in the near future.

Net income for San Diego-based Guild Holdings came in at $42.2 million in the fourth quarter, down from $72.1 million

The company also reported net revenue of $343.1 million in the final three months of last year, 17% below the $413 million generated in the third quarter and 24% lower than $454.2 million from 4Q 2020. Diluted earnings per share equaled $0.69, down from $1.17 in the third quarter and $1.31 a year earlier.

With those falling numbers, Guild’s quarterly decline reflects the widely expected

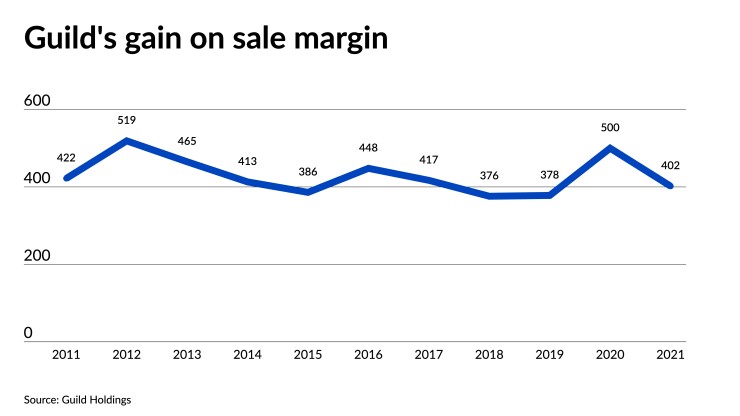

“Consistent with industry trends, our gain on sale margins softened through the course of the year,” said Mary Ann McGarry, Guild’s CEO, in its earnings call.

Gain on sale for originations fell on both a quarterly and annual basis, coming in at 347 basis points at the end of the year, compared to 396 bps three months earlier and 436 bps in the fourth quarter of 2020.

For the full year, Guild posted net income of $283.8 million, 23.4% below 2020’s $370.6 million, while net revenue in 2021 was 2.5% lower, checking in at $1.58 billion compared to $1.62 billion the prior year. Gain-on-sale margin in 2021 was 402 basis points, compared to 500 for 2020.

Smaller gain on sale margins may have led to decreased profits, but the company’s business model, with purchase originations outnumbering refinances, bodes well for Guild despite the current “significant headwinds,” such as steadily increasing interest rates, said Henry Coffey, managing director, equity research at Wedbush Securities.

“Guild has historically captured market share during rising-rate environments, a trend which we believe will continue over the next couple of years,” he wrote in a research note.

With its presence around the country, Guild has the ground team to keep its share of purchases up, according to Coffey. “The primary channel is still those employee or independent brokers that are in that local market, and that's what Guild has,” he said in a recent interview with National Mortgage News. According to company officials on the earnings call, Guild sourced nearly 100% of its volume from its retail loan officers.

Within its originations segment, Guild earned $53.4 million worth of net income in the fourth quarter and $392.8 million for all of 2021, compared to $100.5 million and $765.3 million in 3Q and the prior year. The profit was based on $8.8 billion in generated fourth-quarter volume, below the $10 billion produced in the previous quarter and $10.6 billion over the final three months of 2020. But production was higher on a full-year basis, finishing at $36.8 billion, up from $35.2 billion in 2020.

While current

“Historically, when we've been in a rising interest rate market and the shift from a refinance-dominant market to a purchase, we always see opportunities, so I wouldn't expect anything different,” McGarry said.

“We’re seeing things starting to get more active, and we're very interested,” said Terry Schmidt, Guild’s president, adding that “the pipeline will continue to grow over the next nine months.”

“We like businesses that have a decent market share in their area and where they've got good leadership that wants to stay, and we can take them to the next level under Guild's platform,” she said.

On the other hand, the profits from Guild’s servicing segment picked up, and the company said it expected the unit to hedge against slowing originations over the next year. Net servicing income totaled $27.3 million, up from $10.1 million three months earlier. For the full year, the unit earned $55.6 million compared to 2020’s $184 million loss, much of it due to fair value adjustments of servicing rights. Unpaid balance within Guild’s servicing portfolio grew to $70.9 billion from $68 billion at the end of the third quarter and $60 billion at the close of 2020, an annual increase of 18.1%.