Sen. Larry Craig, R-Idaho, says he is concerned that the comptroller of the currency may have "gone too far" in pre-empting the states' ability to supervise mortgage companies that are subsidiaries of national banks."If the impact of those regulations [is] as sweeping as the director of finance in Idaho says they are, then I think maybe that is going too far," Sen. Craig said after conducting a hearing on ways to protect the elderly from predatory lending. Sen. Craig chairs the Senate Special Committee on Aging. Idaho banking superintendent Gavin Gee testified that mortgage lenders traditionally licensed and supervised by the state are becoming subsidiaries of national banks and turning in their state lending licenses. "We are being pre-empted from taking any kind of enforcement action against those entities or responding to consumer complaints," Mr. Gee told the special committee. After the hearing, the Idaho senator told reporters he will demand a meeting with the comptroller to learn more about the new pre-emption rules. Then he plans to consult with Senate Banking Committee Chairman Richard Shelby, R-Ala., to "see where we go with this."

-

The company dropped the broker channel just months after Frank Martell became CEO; now that Anthony Hsieh is running things again, LoanDepot brought it back.

1h ago -

TransUnion cuts VantageScore 4.0 to $0.99, aiming to boost lender choice and affordability as FHFA pushes mortgage score modernization and competition.

1h ago -

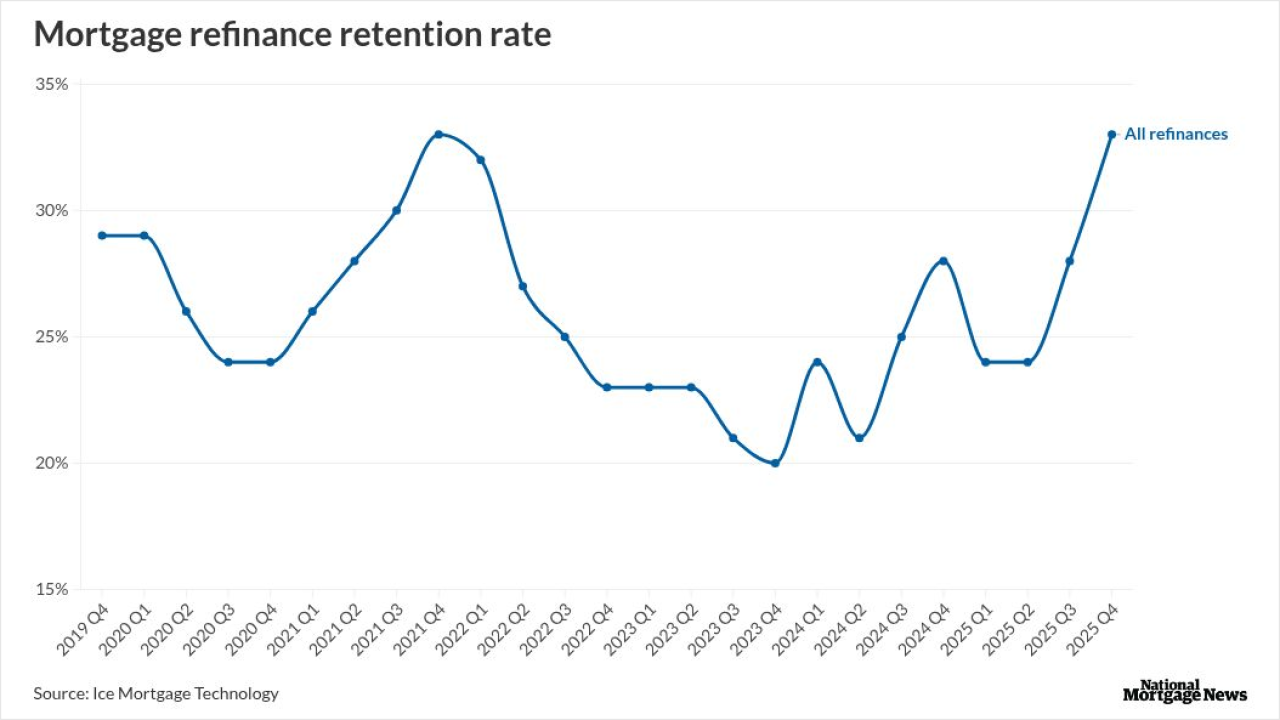

An estimated 565,000 first-lien refinances closed in the fourth quarter, up 50% from a year prior and the most since the second quarter of 2022, ICE found.

2h ago -

Borrowers or lenders could use the prediction markets as a hedging tool, although experts noted the lack of trading volume as cause for caution.

8h ago -

The industry welcomed the Department of Veterans Affairs' plan for implementing legislatively-created borrower relief but some would like more clarification.

March 6 -

While correspondent is still the bulk of Planet Financial's production, growth of its servicing portfolio helped the company increase retention volume.

March 6