The head of one of the nation’s fastest-growing mortgage firms has bought a black-owned bank in Danville, Va.

Movement Mortgage in Charlotte, N.C., confirmed Wednesday that its CEO, Casey Crawford, had recapitalized the $29 million-asset First State Bank. The amount was not disclosed.

“All of it is completed,” said Larry Trapp, First State’s chief financial officer and chief operating officer, noting that the transaction was finalized on June 6. “It worked out well.”

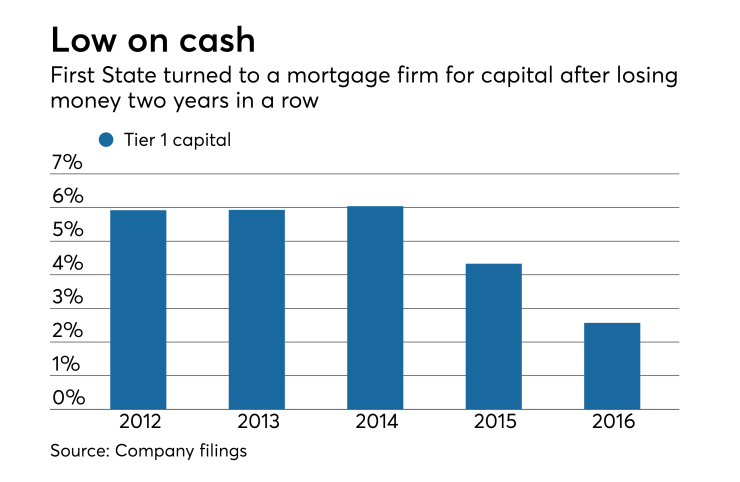

First State, one of just three banks based in Danville, was in need of capital after losing a total of $1 million in 2015 and 2016. It lost another $75,000 in the first quarter. The bank’s total capital ratio was 3.57% at March 31, according to its call report with the Federal Deposit Insurance Corp.

Exactly how, or even if, the mortgage lender and the bank would work together is unclear. Officials at Movement declined to comment on the potential relationship between the entities.

Movement has grown significantly since its founding in 2008. The firm originated $7.8 billion in loans in 2015, or nearly double its production a year earlier, based on Home Mortgage Disclosure Act data.

Movement aims to finance 10% of the homes sold in the United States by 2025.

First State is the second minority-owned bank this month to be sold to a nonminority company. IA Bancorp in Edison, N.J., the parent of the $235 million-asset Indus American Bank,