-

Home sales in the Charlotte, N.C., area are rebounding after taking a major blow from the novel coronavirus pandemic, even as the shortage of homes is worsening.

August 14 -

The Charlotte, N.C., housing market is slowly beginning to recover from the economic downturn of the COVID-19 pandemic, new data from the local real estate association show.

July 12 -

Several Senate Banking Committee members from both parties are facing tough reelection challenges in a year when control of the entire chamber — and the banking policy agenda — may be up for grabs.

May 29 -

As the economic fallout from the novel coronavirus pandemic continues to widen, the Charlotte area housing market saw its largest drop in home sales last month in over a decade.

May 13 -

To address the coronavirus' impact, banks like Truist and Ally and nonbanks like Quicken Loans are assisting communities as well as making adjustments to support their workforce and customers.

March 19 -

The North Carolina company will hold onto the loans after the Fed's decision to slash interest rates.

March 11 -

Home sales were up in all three of the Greensboro-High Point, N.C., metropolitan area's counties of Guilford, Randolph and Rockingham.

February 3 -

A Charlotte, N.C., developer detailed plans to build apartments and commercial space through a federal tax program that has faced scrutiny in recent months.

January 7 -

Wyndham Capital Mortgage realigned its executive suite with the promotions of Ben Cowen to president and Josh Hankins to chief operating officer.

January 6 -

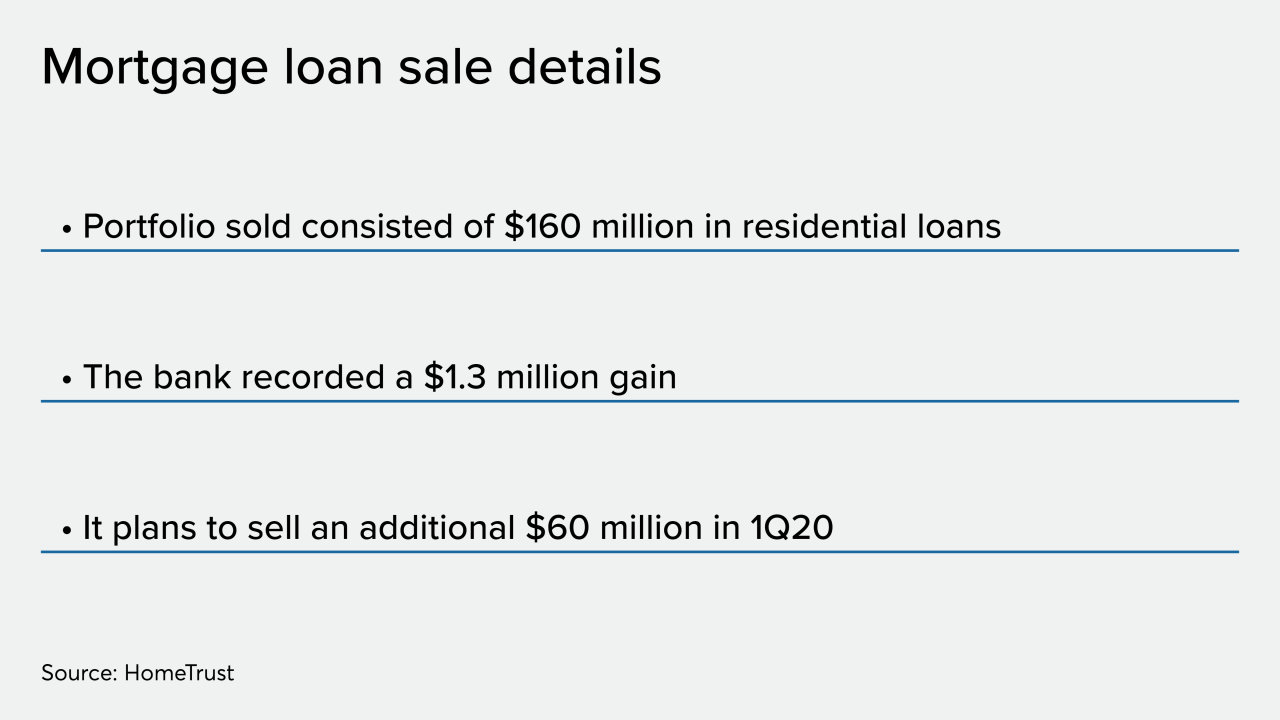

HomeTrust Bancshares in Asheville, N.C., sold a portfolio of residential mortgages as part of a balance sheet restructuring, with plans to sell more.

December 20 -

Charlotte's housing market saw a welcome spike in sales in September, but the lack of supply of homes continues to worsen.

October 22 -

Spooked that the newly renovated house you're about to buy in Charlotte may be haunted?

October 17 -

Home sales in the Wilmington, N.C., area finished the summer strong and steady, according to August figures from the Cape Fear Realtors.

October 9 -

The residential construction market is giving off conflicting signals about whether the nation is heading toward a downturn, according to BuildFax.

September 17 -

A key measure of the sales prices for homes saw its largest jump this year, as Charlotte's real estate market continues to struggle with a shortage of homes and rising demand.

August 13 -

Will the new commitment, which is 5% over what the banks have reinvested recently on their own, assuage advocacy groups' concerns about the merger?

July 22 -

Prime selling season is in full swing, but despite another month of a slight increase in home sales, Charlotte still has a low supply of houses for sale.

June 20 -

The potential for longer homeowner recovery times from hurricanes could hurt mortgage companies that need to advance funds to investors from missed payments.

May 15 -

Some good news emerged in the housing market recently, but there's one factor that means homebuyers aren't likely to see any relief soon: low supply.

May 14 -

Homes in Charlotte are selling fast. Prices are shooting up. Demand is growing.

March 18