CFBank is exiting direct-to-consumer mortgage originations, citing higher expenses in a changing market, and will instead concentrate on traditional branch retail lending.

In particular, the bank is dealing with increased early payoff fee expenses from loans originated in this channel. When combined with

Additionally, factors like mortgage loan price volatility, fewer refinance originations, margin compression and increased competition made the direct-to-consumer business less viable in the current environment, the bank said.

Many mortgage lenders, such as

Until recently, consumer direct was a plus for CFBank; since it entered in 2018, it has been a significant driver of fee income. That has allowed it to expand its footprint and presence in other businesses, plus build capital, said Timothy O'Dell, president and CEO, in a press release.

"The investments we have been able to make over the past few years in cash management staff and capabilities is producing significant growth in non-interest-bearing deposits, along with accompanying fee income generated through cash management products and services, while the investments in our commercial lending staff have resulted in our commercial loan pipelines being at all-time highs," O'Dell pointed out.

It originated $2.2 billion for all of 2020, up from $734 million in 2019, "due to the expansion of our leads-based mortgage business and increased sales activity," parent company CF Bankshares 10-K filing said. But the bank sells all of its production on the secondary market servicing-released.

Without providing specific volume figures, its first quarter filing pointed out that "while originations were reasonably strong during the quarter ended March 31, 2021, margins have declined substantially since the fourth quarter of 2020."

Its filing for the period noted that CFBank had $6.36 million of net revenue in the first quarter for its mortgage activities, compared with $2.84 million one year prior.

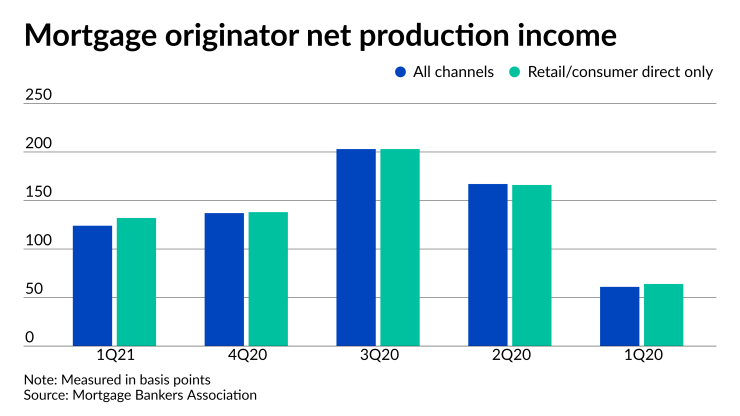

Loan origination income for the entire industry has been on the downswing since the mid-point of 2020, Mortgage Bankers Association studies found.

Total net production income for mortgage lenders was 124 basis points

The MBA results lump retail and consumer direct together, and as a group they had net production income of 132 bps for the first quarter. This is down from 138 bps in the fourth quarter and 203 bps in the third quarter.