A friend of Fannie Mae Chief Economist Doug Duncan recently sold his fixer upper house at a price that would have made more sense if certain repairs had been made before it was listed.

That friend had knowledge of the building and wood products business, areas where shortages are affecting the housing market.

"It was a cash sale but his estimate was that it needed $75,000 worth of repairs," Duncan said in a recent interview with National Mortgage News. "So he was happy to sell because he didn't want to do the repairs himself, then he got the price as though it had been repaired. That's evidence of a pretty strong market."

Meanwhile,

But mortgage industry economists like Duncan and his counterpart at the Mortgage Bankers Association, Mike Fratantoni, are adamant that there is no bubble and that a collapse similar to

"To me a bubble would be prices moving really apart and adrift from fundamentals and everything I've talked about here really is a fundamental story — that we have strong demand from an improving economy, very favorable demographics as

Backing that up, he said, was data from Moody's regarding short-term home purchasers, also known as flippers. Back in 2005, 20% of buyers owned the property for one year or less.

Currently, the number is down to about 7%.

"The people buying homes today are just trying to live there," said Fratantoni. "They certainly would be happy if the value continues to increase after they buy, but they're not looking for a short-term turnaround, so we don't have the bubble dynamics that we had in the first part of the 2000s and leading up to the crash."

As far back as 2013 and

The MBA's forecast is "relatively optimistic," expecting the pace of home value increases to decelerate as the supply issues work themselves out.

"The alternative is we keep running at this double-digit rate of home price growth for a couple more quarters and then affordability difficulties rise to such a level that we really price first-time home buyers out of the market," Fratantoni said. "And then you see transaction volume fall, and you'd see it fall pretty quickly, similar to what we saw towards the end of 2018 that was more a result of

And if the

"So if you had this burst of inflation that is unsustainable, the Fed reacts, tightens aggressively, the economy turns down, you see significant job loss particularly in some sectors that haven't fully recovered to begin with, then sure, prices could go down," Duncan said. "Is that a bubble? I don't view that as a bubble, but it's a scenario in which you can see a price decline brought about by the confluence of policy and economics."

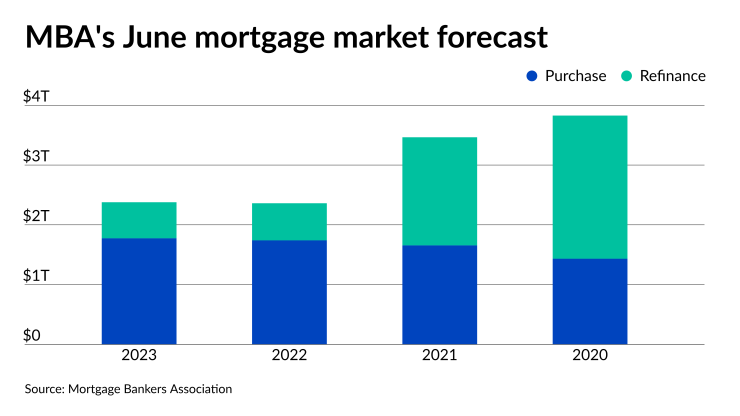

The MBA released its latest origination forecast on June 16. It is now predicting $3.47 trillion in volume for this year, up from $3.4 trillion in May, with all of the additional production coming from increases in refinancings.

It also increased its estimates for refis over the next two years; that higher projection is nowhere near levels seen in 2020 and the first half of 2021. Though its purchase forecast is unchanged, new annual records for mortgages to buy homes will be set through 2023.

But the threat of

MBA expects the 30-year fixed to reach 3.5% at the end of this year, 4.2% in 2022 and 4.7% in 2023.