Mortgage banking revenue stemming from a year-to-year increase in rates weighed down noninterest income at U.S. Bancorp, but increased interest income from higher rates helped improve earnings overall.

"Revenues improved, aided by the rise in net interest, as well as fee income," according to a Zachs Equity Research report. But "escalating expenses and lower mortgage banking revenues were major drags."

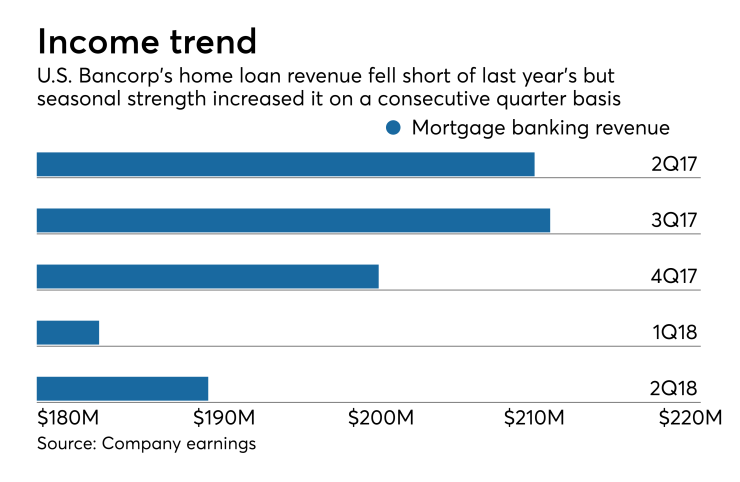

Mortgage banking revenue fell to $191 million in the second quarter from $212 million a year ago due to competition in the market that continues to put pressure on margins. However, mortgage banking income was up from $184 million in the previous quarter, which tends to be seasonally weak.

Lower mortgage origination volumes driven by the increase in rates over the past year are the main cause of the competition that has put downward pressure on mortgage revenue. But higher rates have had some upsides for the mortgage business as well, and a rate-driven gain in the net value of the U.S. Bancorp's mortgage servicing rights partially offset what otherwise have been a more pronounced decline in income for home loans at the company.

U.S. Bancorp's mortgage production volume fell just short of year-ago levels at more than $10.98 billion as compared to almost $11 billion last year, and was up from almost $10 billion in the first quarter of this year.

U.S. Bancorp overall generated $1.75 billion in net income, or $1.02 diluted earnings per share in the second quarter, up 16.7% from