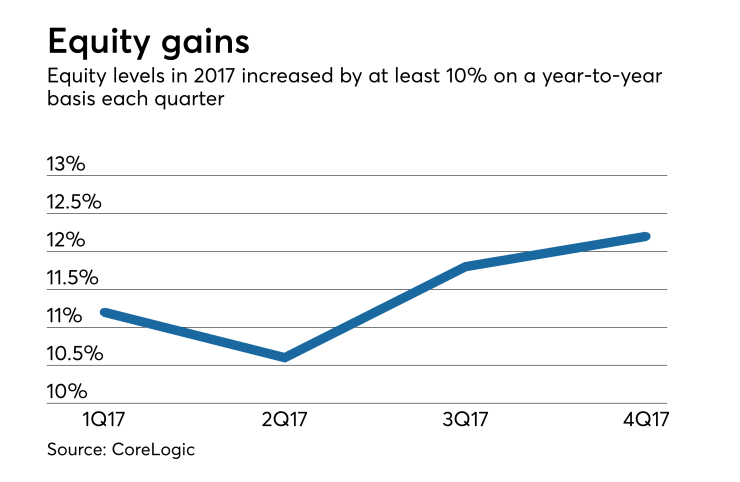

Home equity levels increased year-to-year in the fourth quarter of 2017 following a larger-than-expected surge in home prices during the past year.

Homeowners with mortgages, or 63% of all properties, had 12.2% more home equity during the fourth quarter of 2017 than they did the fourth quarter of 2016. In comparison, equity levels

"The average growth in home equity was more than $15,000 during 2017, the most in four years," said CoreLogic Chief Economist Frank Nothaft in a press release. "Because wealth gains spur additional consumer purchases, the rise in home-equity wealth during 2017 should add more than $50 billion to U.S. consumption spending over the next two to three years.”

Properties with homes worth less than their outstanding mortgage balances decreased 21% year-over-year in the fourth quarter. Fewer than 5% of all properties now have negative equity, down considerably from the post-crisis peak of 26% in the fourth quarter of 2009.

Markets with the highest share of negative equity include the Miami metropolitan area (13.1%), the Chicago metro area (10.1%), and the Las Vegas metro area (9.2%).

“There are wide disparities in home-equity gains by geographic area, with higher-priced, capacity constrained markets along the East and West Coasts registering the largest increases,” said Frank Martell, president and CEO of CoreLogic, in the press release.

“The average homeowner in California and Washington had a wealth gain of about $40,000, reflecting the high price of homes in California and the rapid appreciation in Washington. In contrast, the average owner in Louisiana had little change in their housing wealth during 2017.”