Home Point Capital’s bottom-line underperformed some analysts’ estimates in the latest quarter as it continued to struggle with

The company recorded $19.3 million in net income for the quarter, down from $71.3 million the previous fiscal period and $184.5 million during the last three months of 2020. For the year, its bottom-line result was $166.3 million, compared to $607 million during a year earlier. Net revenue was lower as well at $961.5 million in 2021 compared to almost $1.38 billion in 2020. For the fourth quarter of last year, revenue was $180.5 million. This was down from $274.6 million for the previous quarter and $453.9 million in 4Q20.

The 4Q21 revenue number beat Zacks’ consensus estimate by 0.86%, thanks in part to the sale of $13.1 billion worth of

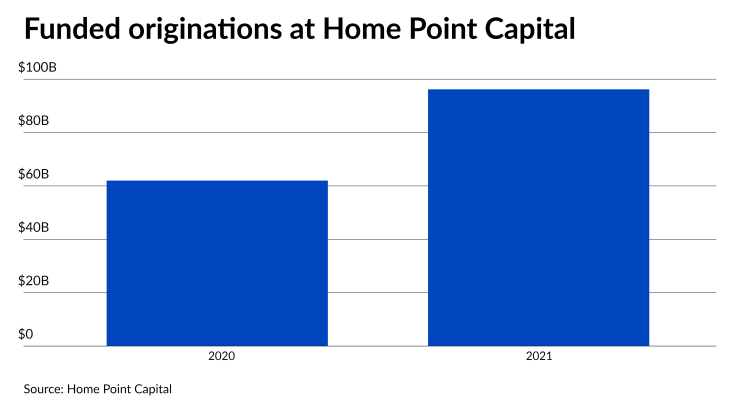

The company’s Homepoint subsidiary also topped its previous record for annual loan volume even though the quarterly metric in this category was slightly lower. Full-year funded originations totaled $96.2 billion, compared to $62 billion in 2020 thanks to aggressive expansion of the company’s network of mortgage brokers and correspondent loan sellers, according to Home Point Capital CEO Willie Newman. During the fourth quarter, originations funded through the company’s subsidiary totaled a little over $20.5 billion, compared to nearly $20.8 billion the previous fiscal period and almost $24 billion in 4Q20.

“Our origination volume was propelled by the strong expansion we made to our partner network throughout the year,” Newman said during the company’s earnings call. “In the fourth quarter, we had 560 new broker partners and in total for 2021, our third party partner relationships increased by nearly 50%.”

Homepoint ended the fourth quarter with more than 8,000 broker and 676 correspondent relationships. “Our new broker partners represent a significant opportunity and provide us with a springboard for market share in 2022,” Newman said.

The company’s bottom-line result translated to a loss after adjustments for non-recurring charges and that figure came in below Zacks’ estimates. The company recorded a loss of $12.3 million for the fourth quarter of 2021 based on this measure, compared to adjusted net income of $15.1 million for the previous fiscal period and $171 million during 4Q20. That fourth-quarter 2021 figure equated to a loss of $0.09 per share. Zacks had estimated a gain of $0.07 per share.

Home Point Capital has aggressive cost-cutting measures underway to improve its bottom line in addition to plans to continue to maximize the revenues it can derive from servicing as production margins thin, Newman said. Gain-on-sale margins fell to 59 basis points during the fourth quarter of 2021, compared to 84 the previous quarter and 216 a year earlier.

“To offset some of that margin pressure, we continue to accelerate our efforts to deploy new technology that will have lower costs,” he said, noting that the company has made headway in expense reduction. The company recorded $152.2 million in expenses during the fourth quarter of 2021, down from $175.3 million the previous fiscal period, and $223 million in 4Q20.