-

As the Federal Open Market Committee announces its near-term interest rate plans Wednesday, market watchers expect the central bank to hold interest rates steady as policymakers seek greater clarity on the health of the economy.

January 28 -

Federal Reserve Vice Chair for Supervision Michelle Bowman warned that labor market conditions could weaken further and said the central bank should avoid signaling a pause in monetary policy.

January 16 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

The Federal Reserve's interest rate-setting committee is widely expected to cut rates by 25 basis points today, but where the central bank goes from here is an open question.

December 10 -

Federal Reserve watchers expect a board of governors vote in February to reappoint the 12 regional Fed bank presidents — which is typically treated as a formality — to be the next flashpoint in the White House's effort to bring the central bank to heel.

December 8 -

Federal Reserve Gov. Christopher Waller said in a speech Monday that private and public-sector data suggests that the labor market is continuing to weaken, making a 25 basis point rate cut in December a prudent choice.

November 17 -

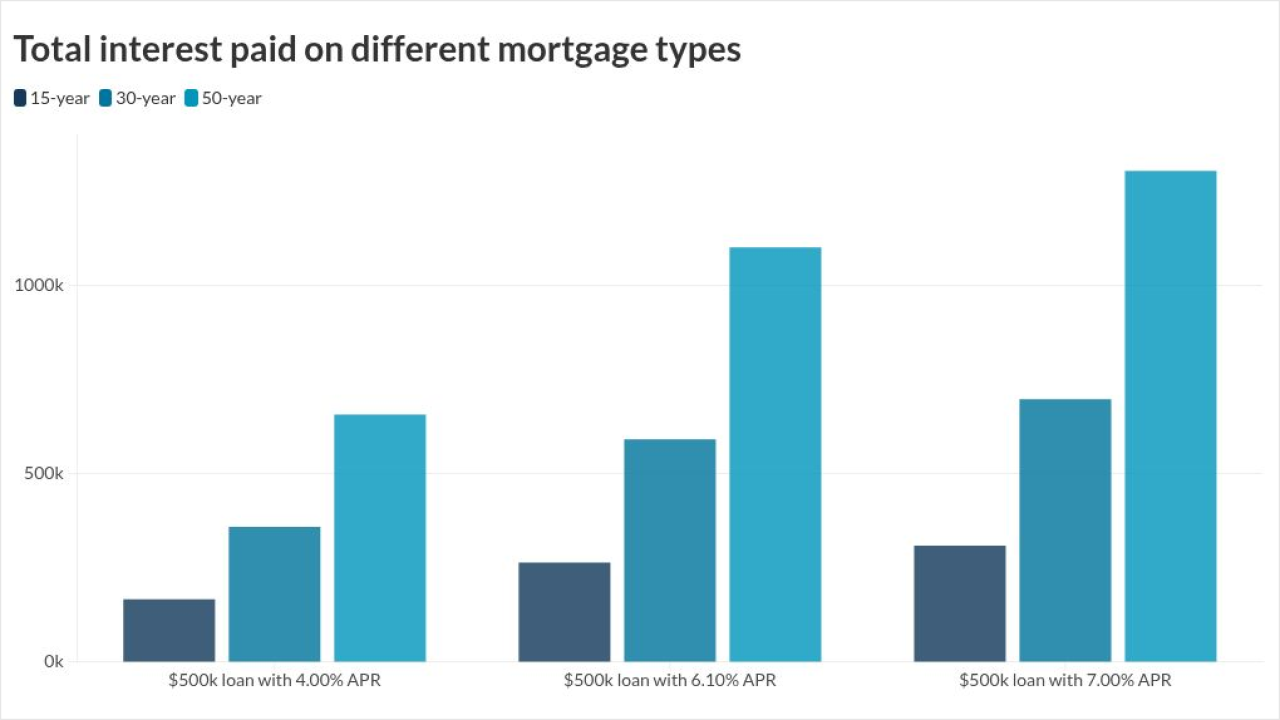

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

Federal Reserve Governor Stephen Miran said emerging stresses in housing and private credit markets warrant a reduction to short-term interest rates. While preferring a 50 basis point cut in December, Miran said he would settle for a 25 basis point reduction.

November 10 -

In her first public appearance since President Trump moved to fire her from the Federal Reserve Board of Governors, Fed Gov. Lisa Cook reiterated her commitment to bringing inflation under 2% and said that the labor market remains "solid."

November 3 -

The Federal Open Market Committee voted to reduce interest rates by 25 basis points Wednesday, but the emergence of dissents on the committee makes the chance of another quarter-point cut in December less certain.

October 29 -

The Federal Reserve's interest rate-setting body is expected to announce a 25 basis point cut and provide guidance on the trajectory of its balance sheet Wednesday afternoon.

October 29 -

The Federal Open Market Committee is expected to announce guidance on the end of its quantitative tightening program later Wednesday. As that process draws to a close, experts are questioning when and how the central bank should use its balance sheet to smooth economic stress in the future.

October 29 -

Federal Reserve Governor Stephan Miran said the economic standoff with China could increase market volatility, further necessitating the central bank to move its policy stance to neutral.

October 15 -

Total mortgage origination volume is forecasted to barely eclipse $2 trillion by the end of the year for the first time since 2022, iEmergent said.

October 9 -

Federal Reserve Gov. Michael Barr said in a speech Thursday that he fears the gradual pace of price increases from tariffs being passed on to consumers may prolong the one-time inflationary effect of the tariffs to the point where it affects consumers' inflation expectations.

October 9 -

Federal Reserve Gov. Stephen Miran sidestepped whether policy setting pressure from the administration is a welcomed development, but reiterated that he wants to avoid succumbing to "groupthink."

October 7 -

Federal Reserve Bank of Kansas City President Jeff Schmid said that the central bank should continue its focus on curbing inflation, as the job market is "largely in balance."

September 25 -

Federal Reserve Chair Jerome Powell said in a speech Tuesday that the central bank's policy stance is "modestly restrictive," a stance that will give the central bank flexibility to react to an uncertain economic future.

September 23