Home Point Capital touted its growth in the wholesale origination channel during 2020, and put in its two cents on the battle between its area rivals Rocket Cos. and United Wholesale Mortgage in an earnings call Thursday.

When asked what Home Point was hearing from mortgage brokers following

The war of words seems to be accelerating Homepoint's growth in the wholesale channel, he said.

"What we've seen in the last week is that we've had significant inbound inquiries from a new relationship standpoint and we're excited about that," said Newman. "We think that is definitely a testament to the strategy that we've developed and how we've differentiated ourselves."

While Homepoint originates in all three channels, its platform has been designed to compete in wholesale "in a way that leverages scale and optimizes returns with lower fixed costs," and that was shown by its growth, he said.

The company added 2,354 new third-party origination relationships (both mortgage broker and correspondent) during 2020. In total, it increased its customer base by significantly broadening these partnerships by 74% to 5,976 at year-end

Because of that increase in interest, Newman is expecting a faster pace of growth in wholesale than Homepoint saw in 2020.

Mortgage brokers are telling Homepoint that they "are looking for another large source," Newman said. "There's a lot of concern about not having the level of choice they've come to appreciate, I guess prior to the announcement of last week."

Homepoint is well-positioned to be "that next choice if it does turn out that they only have one of the two largest other lenders to work with," he continued.

In its first report since it

For the full year 2020, Home Point earned $607 million, compared with a net loss of $29.2 million for 2019.

Homepoint, the mortgage lending unit, had volume of $24 billion in the fourth quarter, a record for the company. By channel, wholesale produced $14.1 billion, correspondent purchased $8.6 billion and direct generated $1.25 billion in production.

In the third quarter, Homepoint funded $18.1 billion in total volume, with just under $11 billion coming from wholesale and $6.3 billion from correspondent. One year ago, Homepoint's total volume was $8.3 billion, of which $4.5 billion was wholesale and $3.5 billion was correspondent.

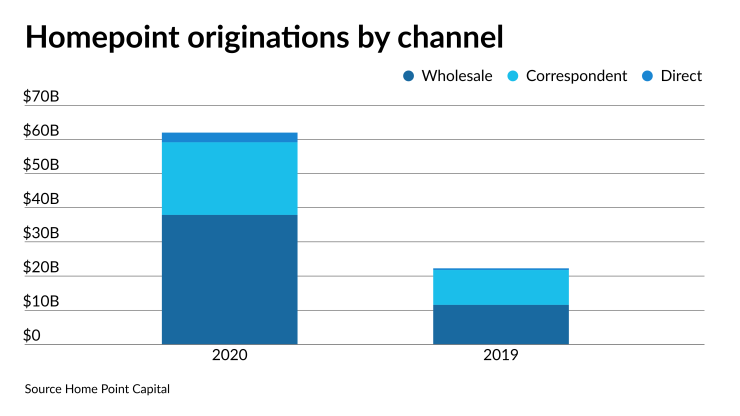

During 2020, Homepoint originated $62 billion, made up of $37.9 billion in wholesale, $21.3 billion of correspondent and $2.8 billion of direct. Its 2019 production totaled $22.6 billion, with $11.6 billion of wholesale originations, $10.2 billion of correspondent and $487 million from the direct channel.

Gain on sale margin was 176 basis points in the fourth quarter, down from 278 bps in the third quarter but more than double the 77 bps in the fourth quarter of 2019.

When asked about movements in this metric going forward, Newman replied, "One of the challenges is that, from day to day and week-to-week, you can literally see pretty meaningful swings. But over time, we feel like that kind of around 100 is where it typically hits its lows.”

That doesn't mean the gain on sale margin couldn't go below that, but Newman said that’s typically how low he’s seen it get in his 30-year career in the business.

In general, Home Point executives declined to provide forecasts for future earnings.

The "contribution margin" from originations was $302.4 million in the fourth quarter, versus $424.6 million in the third quarter and $29.1 million in the fourth quarter of 2019.

For the servicing business, there was a loss of $34 million, compared with a $20 million loss in the third quarter but a $3.1 million gain one year prior.