The House has nixed a 12-month extension of the National Flood Insurance Program favored by the Senate and approved a short-term extension in hopes of getting Congress to consider flood insurance reforms next year.On Nov. 21, the House took up the Senate bill (S. 1768), stripped out the 12-month extension, and inserted a three-month extension. The House is currently in recess and is expected to return in early December to approve an omnibus appropriations bill. It is now up to the Senate to accept the three-month extension or counter with an alternative -- possibly a six-month extension. The flood insurance program is due to expire Dec. 31. In seeking a short-term extension, the House wants the Senate to consider an NFIP bill (H.R. 253) that is designed to reduce the cost of repetitive flood insurance claims.

-

The company also revealed more about the impacts of its data breach, and said it doesn't consider the development likely to materially affect its results.

1h ago -

The fourth quarter results integrated the operations of both Redfin and Mr. Cooper into Rocket Cos., with the deals likely contributing to the full year loss.

5h ago -

MBS buying has become the near-term focus but a 2026 offering is still possible, Federal Housing Finance Agency official Bill Pulte told Fox Business.

5h ago -

Rocket Mortgage and Compass launched a three-year Redfin listing partnership, expanding access to 500,000+ homes, with executives saying they see no RESPA compliance issues.

5h ago -

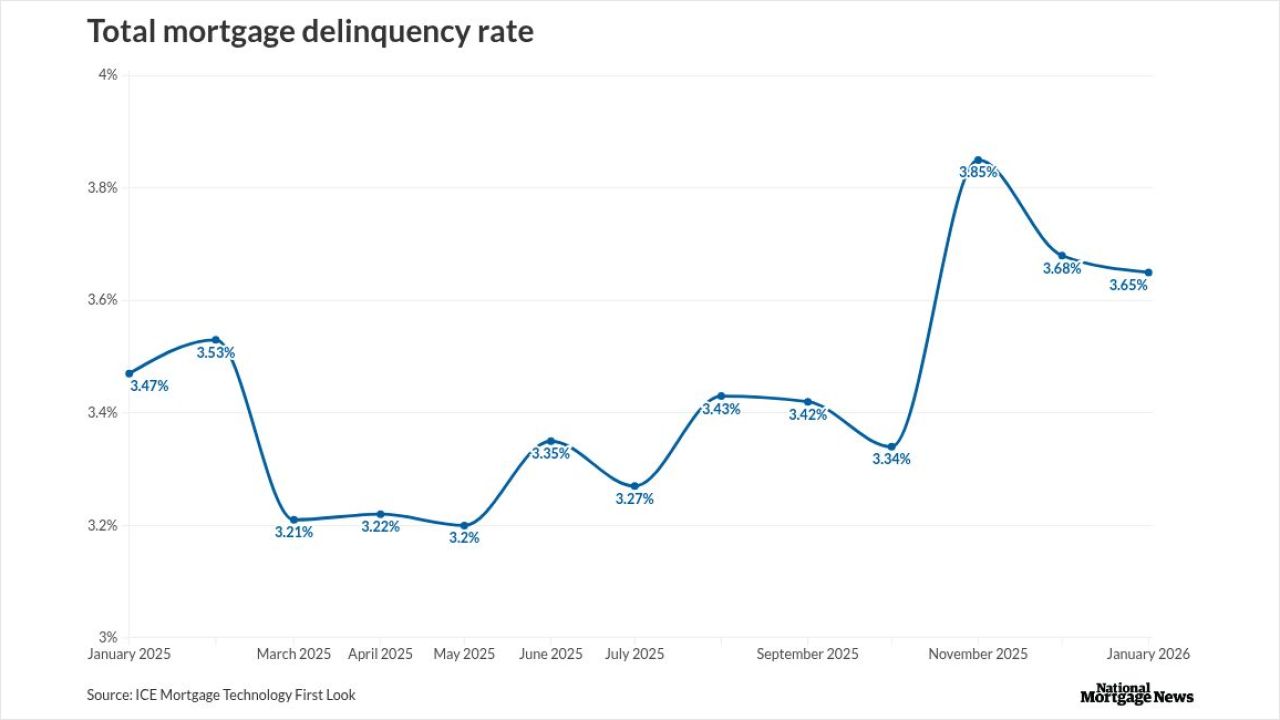

While overall delinquencies eased in January, foreclosure starts jumped to their highest point since early 2020, signaling growing strain among late-stage borrowers despite steady mortgage performance.

7h ago -

Senate Majority Leader John Thune, R-S.D., moved to consider the housing package next week, but it's not clear what version of the bill senators will be voting on as the House, Senate and White House are still negotiating priorities.

8h ago