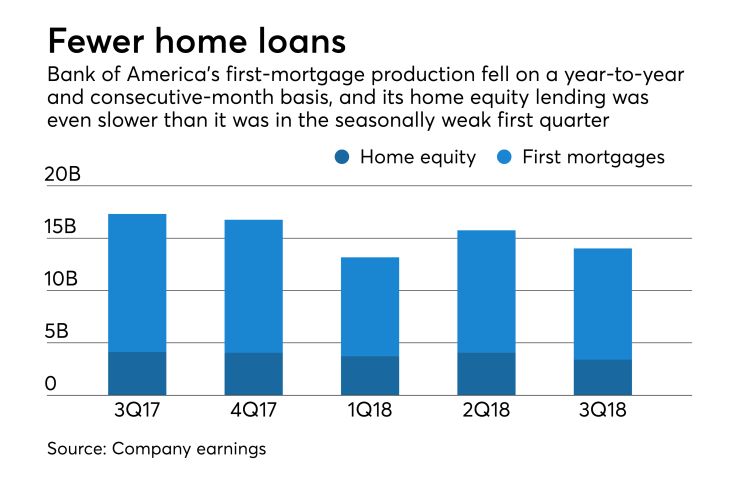

A notable drop in home equity lending at Bank of America during the third quarter contributed to an overall decline in new single-family loans produced by the company.

The publicly traded company produced more than $14 billion in first mortgages and home equity loans during the fiscal period, down from more than $17 billion a year earlier, and almost $16 billion in 2Q 2018.

Home equity lending fell to a little over $3 billion from more than $4 billion the previous quarter and a year ago. Even in the seasonally weak first quarter, home equity volume had been stronger and closer to $4 billion than $3 billion.

First-mortgage production held up better than home equity did at nearly $11 billion in the third quarter, even though it dropped below year-ago and consecutive-quarter levels. A year ago, Bank of America generated more than $13 billion in first mortgages, and in the second quarter it produced more than $11 billion.

Bank of America continued its push toward digital sourcing of mortgages in the third quarter. One out of every five consumer mortgage applications came in through the digital channel, according to the company's earnings release. The company launched

More broadly, home mortgage origination numbers in third-quarter earnings to date generally have been

Although home loan production at Bank of America was lower in the third quarter, its