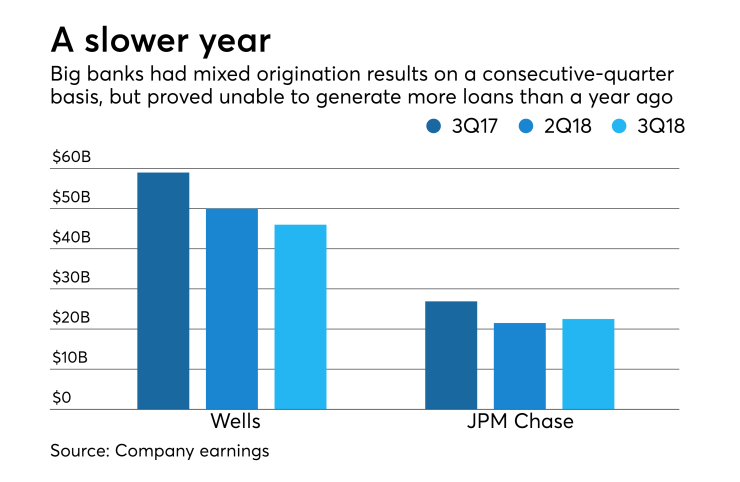

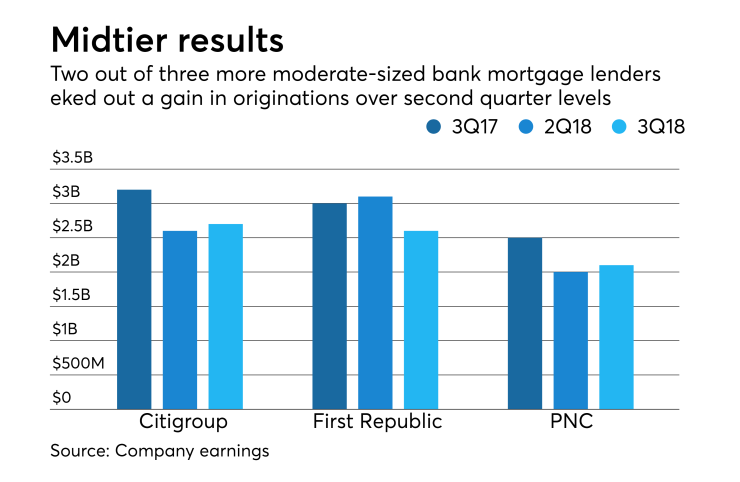

Mortgage-related earnings at Wells Fargo, JPMorgan Chase, Citigroup, First Republic Bank and PNC Financial Services Group were down from a year ago, even though late-season homebuyers improved some consecutive-quarter origination numbers.

Originations in the third quarter were lower than they were a year ago due to the higher interest rates in the market this year, but three of the banks managed to eke out gains over the

Net mortgage revenue was generally lower on both a month-over-month and a year-over-year basis, but one company did improve on a consecutive-quarter basis even though its origination volume and servicing income was lower.

Noninterest income generated by Wells Fargo's mortgage banking division was $846 million, up from the previous quarter's $770 million, but down from $1 billion a year ago.

The consecutive-quarter gain stemmed from improved secondary market conditions that increased the production margin on residential mortgage originations held for sale to 97 basis points from 77 basis points.

Wells' residential mortgage originations were $46 billion, down from $50 billion in the second quarter, and $59 billion a year ago. Net mortgage servicing income was $390 million, down from $406 million in the second quarter, but up from $309 million in the third quarter of 2017.

At JPMorgan Chase, net home lending revenue for the quarter totaled more than $1.3 billion, down slightly from the second quarter's $1.35 billion, and down from more than $1.5 billion in net mortgage banking revenue in the third quarter of 2017.

Originations produced by JPMorgan Chase's home lending unit rose slightly to $22.5 billion from $21.5 billion in the second quarter, but were down from $26.9 billion a year ago.

Citigroup's mortgage unit generated $134 million in revenue, down from $140 million in the second quarter and from $185 million in the second quarter of last year.

Originations at Citi rose to $2.7 billion from $2.6 billion in the second quarter and were down from $3.2 billion a year ago. Citi in 2017 had decided to sell off

The gain on the sales of mortgages originated by First Republic Bank's mortgage unit was $303,000, down from $4 million the previous quarter and $2 million one year ago.

First Republic's single-family originations totaled more than $2.6 billion, down from $3.1 billion last quarter and down 3% from almost $3 billion a year ago. Net loan servicing fees were more than $3.1 million, down from almost $3.2 million the previous quarter, but down more than 3% from a year ago.

Noninterest income generated by PNC's residential mortgage division was $76 million, down from $84 million in the second quarter and $104 million a year ago. PNC attributed the decline to factors that included lower loan sales and a lower mortgage servicing rights valuation, net of hedges.

Residential mortgage originations at PNC totaled $2.1 billion during the quarter, up slightly from $2 billion in the second quarter, but down from $2.5 billion a year ago. PNC did not break out mortgage servicing revenue in its earnings release, but noted that it was lower and contributed to the reduction in mortgage revenue during the quarter.