While single-family permit issuance ran ahead of last year’s pace in the first quarter, it is now coming in below 2021’s rate, according to the National Association of Home Builders.

NAHB’s latest findings come as other new data from Redfin also revealed the supply of for-sale properties increasing on an annual basis for the first time in three years, providing more signs of falling home-buying momentum this summer.

"The country's economic woes have already cooled the housing market, and they're likely to continue dampening demand," said Redfin Chief Economist Daryl Fairweather in a press release.

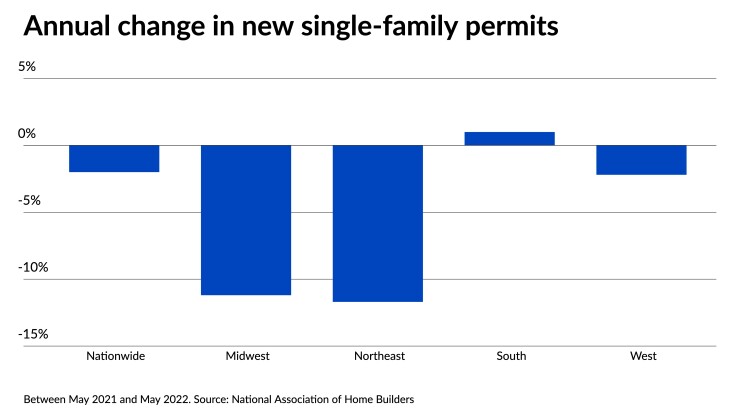

NAHB reported 473,997 single-family housing permits issued this year through May, a 2% decrease from 483,878 a year ago. As recently as March, year-to-date permits were still above 2021’s pace.

Numbers decreased on an annual basis in three out of four U.S. regions, with the Northeast off by 11.7% and the Midwest down 11.2%, while the West registered a smaller drop of 2.2%. Only the South saw an uptick in the volume of permits issued, with numbers rising 1%.

New Mexico led all states with a 42% increase, rising from 2,502 permits to 3,558 in the yearly period ending May 2022. Only 12 states, mostly concentrated in the South and West, reported annual increases, while 10 were responsible for the issuance of over 64% of the nation’s new permits in the yearly period.

Through May this year, three cities in Texas are among the top five metropolitan areas leading the country in new single-family permits issued. Houston outpaces the rest of the U.S. with 24,445, followed by Dallas-Fort Worth at 22,060. Phoenix, Atlanta and Austin, Texas followed with 15,618, 12,580 and 10,597, respectively.

Rising consumer prices and

The available supply of properties for sale rose by almost 2% on an annual basis in June, the first uptick since July 2019, Redfin found. Just a month earlier, available supply had come in more than 4% lower. The swift shift in buying trends has also caused a growing number of

“The Fed has signaled it may increase interest rates further to combat stubbornly high inflation, which could harm consumer confidence, and lower stock prices mean fewer prospective home buyers can afford a down payment,” Fairweather said.

Seasonally adjusted sales also fell by nearly 16% in June compared to a year ago, Redfin said. Also, no single metro area saw a year-over-year increase in home sales, according to its data.

For homebuilders, the

Business conditions are eroding to such a degree that some bank analysts last month downgraded their ratings of the segment’s