Editor's note: This is the first in a three-part series from the July issue of National Mortgage News magazine on United Wholesale Mortgage. Read

When the housing crisis sent big banks fleeing from third-party originations, family-owned United Wholesale Mortgage doubled-down on the channel, investing in innovative technologies and marketing strategies to appeal to mortgage brokers.

UWM became the largest wholesale lender after the channel hit rock bottom earlier this decade. Now that third-party originations are making a comeback, the company is determined to chip away at the retail channel's market share.

At the same time, UWM must protect its position from a growing number of wholesale competitors. To do this, President and CEO Mat Ishbia has set out to be an ally to mortgage brokers in unprecedented ways, particularly when it comes to technology, referral marketing and improving operational efficiencies.

In doing so, UWM is seeking to remake a piece of the wholesale channel by encouraging brokers to think beyond

For example, the company is working to improve mortgage brokers' digital reach in a market where busy consumers are apt to shop and apply for loans online. These efforts are prompting debate about customer acquisition and where the

As new entrants are drawn to wholesale lending by its lower-cost structure, it remains to be seen whether UWM's tactics will remain relevant in the face of this rising competition and the threat of a race to the bottom if the channel becomes more commoditized.

Key to this question is whether wholesalers can rely on broker loyalties as the channel becomes more crowded. While brokers value those close relationships, they don't want to devote themselves to any particular lender to the point that it would pose a conflict of interest with their obligations to borrowers.

But by doubling down on this approach, Ishbia is banking on UWM's ability to meet the needs of borrowers and brokers alike, while turning a profit at the same time.

Ask Ishbia about any of his competitors and the answer is always the same: "Whatever is best for consumers is going to win at the end of the day."

With the help of its brokers, UWM is winning the wholesale channel. The privately held, family-run lender lays claim to a 15% to 20% share of the wholesale market and is widely identified as the channel's biggest player.

It is a far cry from the publicly traded banking giants that dominated wholesale before 2008, and in that sense, the company is emblematic of wholesale's general state since the mortgage crisis: a lower-profile business dominated by a small number of nonbanks.

"One of the big focuses today is to get the price of origination down."

— Bill Pearce, CEO and chairman of Maxex

But at least one aspect of that is changing: wholesale has a higher profile.

On one hand, Ishbia considers this a "rising tide that lifts all boats." But he also acknowledges UWM may be facing more competition from companies with business models too close to his own.

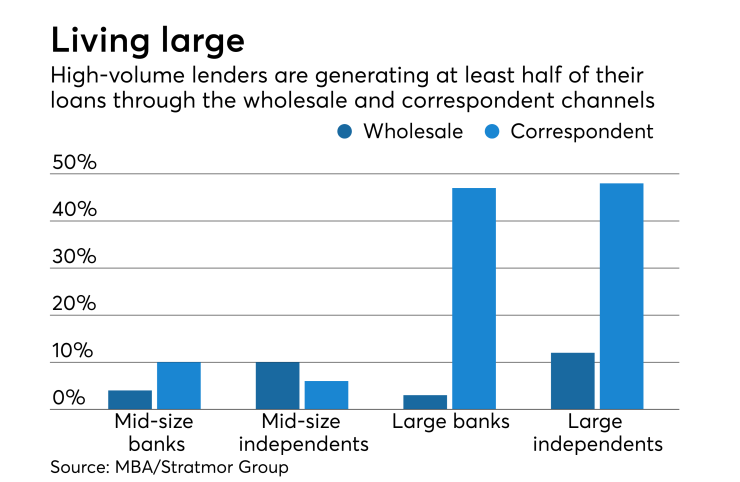

Retail may still dominate the business, but among larger nonbanks, it is losing ground to

Large independents last year generated just 29% of their business through the retail channel, according to peer-group studies by the Mortgage Bankers Association and Stratmor Group. They originated the remaining 71% of their volume through wholesale, correspondent or consumer direct.

"One of the big focuses today is to get the price of origination down," said Bill Pearce, CEO and chairman of Maxex, a secondary market and due diligence platform.

All mortgage channels are susceptible to price wars, given the thinning volumes and margins throughout the industry. But since wholesalers must contend for business on a loan-by-loan basis, price competition is extraordinarily tough.

Emphasizing service rather than price is a way to address that concern, Ishbia said. Some borrowers want nothing but the lowest prices, but others have different priorities, he noted.

"A close on a particular date may be the No. 1 priority, the second priority may be the lowest rate and the third priority might be the cheapest closing cost," Ishbia said.