Impac Mortgage Holdings, which once regarded its push into the non-qualified mortgage market as the

But for now, as the non-QM market remains battered by the economic slowdown, the firm is concentrating on the conforming and government products that have a more stable secondary market outlet.

The company reported a first-quarter loss of $64.7 million — a smidge higher than

"The company is currently evaluating the nonagency jumbo and [non-qualified mortgage] products and will continue to monitor these market segments as facts and circumstances evolve," said George Mangiaracina, chairman and CEO. "We're prepared to participate in the reemergence of non-QM lending. Non-QM has been a key differentiator for the company and aligns with our historical position as the leader of alternative credit."

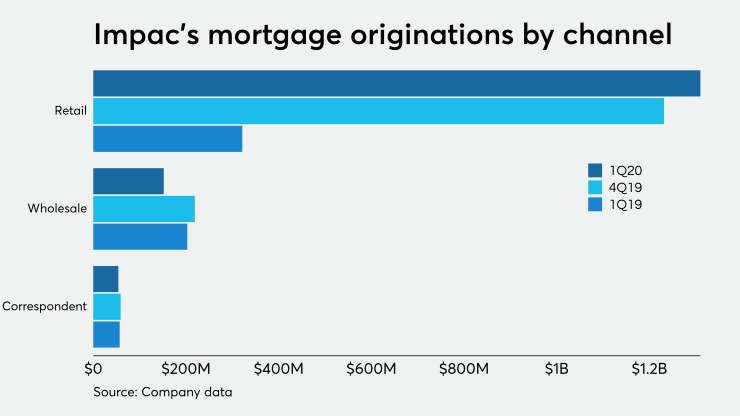

Nearly all of Impac's third-party originations in the first quarter were non-QM: $150.9 million of the $152.1 million total from wholesale and $53.3 of the $54.2 million from correspondent. Retail was the opposite, with non-QM making up a mere $57.4 million from the $1.3 billion that channel produced in the quarter.

Even with dwindling originations midway through March due to

At the end of March, Impac

Impac's first quarter should have been even better, Mangiaracina said on the conference call. "The company was poised to record a significant increase in originations for March, with capacity projected at approximately $1.4 billion, up from $190 million in March of 2019," he said. Instead, it curtailed originations for the month at $350 million.

Given the secondary markets' reluctance to buy non-QM loans, Impac took a loss on the sale of its originations of $28.16 million in the first quarter. In the fourth quarter, it had a gain on sales, at $26.07 million, while the first quarter of 2019 saw a gain of $12.21 million.

In addition, because of the interest rate environment that requires the company to mark down the value of its MSRs, the servicing business lost $18.3 million in the first quarter.

In its current origination configuration, Impac is targeting $250 million in volume by the end of the third quarter in the retail/call center channel alone, which provides "a baseline of profitability for the origination platform," said Tiffany Entsminger, chief risk officer and head of operations. In 2015, Impac acquired

Impac is also updating the product offerings in its wholesale channel to add GSE-eligibility and government options. "Originating loans with strong credit quality, maximizing operational efficiencies, optimizing geographical diversity in the portfolio while continuing to be sensitive and alert to changing consumer needs on forbearance and COVID-related hardships will be top of mind during the next quarter," she said.

That doesn't mean the company is abandoning the non-QM market. The company was "a pioneer in both the alt-A and non-QM space. We continue to have a strong appetite around non-QM and continue to pay attention to the changing forbearance landscape, borrower behavior and appropriate risk-based pricing for these products," said Justin Moisio, chief administrative officer.

While there are published

But there's a cloud on the horizon. The Consumer Financial Protection Bureau's proposal

Even with the addition of conforming products to their offerings, the TPO channels are "foundational for our non-QM business which is potentially six months away predicated on uniform standardization of forbearance," said Paul Licon, chief financial officer.

Impac is engaged with the special servicer on how to handle non-qualified mortgages in forbearances.

In May, as previously disclosed, Impac sold a $4.2 billion Freddie Mac MSR portfolio. Giving more details about the transaction, Tom Donatacci, chief of staff, business development, said the sale was conducted via a market auction. The winning bid was 51 basis points, or approximately $20.1 million.

"The transaction was executed during a time of significant market volatility where we saw MSR prices and liquidity in a decline, so the results were satisfactory and at the upper end of our expectations," said Donatacci.