Stewart Information Services Corp. posted net income in the first quarter of $4.1 million, a turnaround from the $11.2 million loss one year ago.

This quarter's results included a $1.7 million net income tax benefit, while the year-ago loss was driven by $10.4 million of various charges.

Its title insurance business had pretax income of $12.3 million on revenue of $425.8 million. For the same period in 2016, it lost $600,000 on revenue of $413.5 million.

"First quarters are traditionally the weakest of the year for the title industry, and we are encouraged with the progress achieved by our title segment, which generated a $13 million pretax income improvement relative to title revenue growth of $10 million over the prior year quarter," CEO Matthew W. Morris said in a press release.

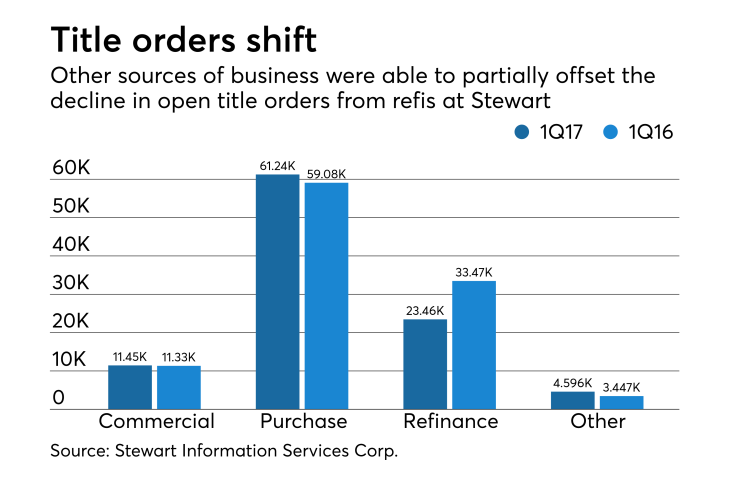

Even though total new orders opened fell to 100,744 from 107,326 in the first quarter of 2016, title orders for home purchases increased to 61,242 from 59,081 year over year.

Stewart's ancillary services and corporate segment had a pretax loss of $6.4 million, a 58% improvement over the pretax loss of $15.1 million in the first quarter last year.

Revenue was down 22% because of Stewart exiting the delinquent loan servicing operations business in the first quarter of 2016 and its divestitures of the loan file review, quality control services and government services lines of business at the end of 2016.