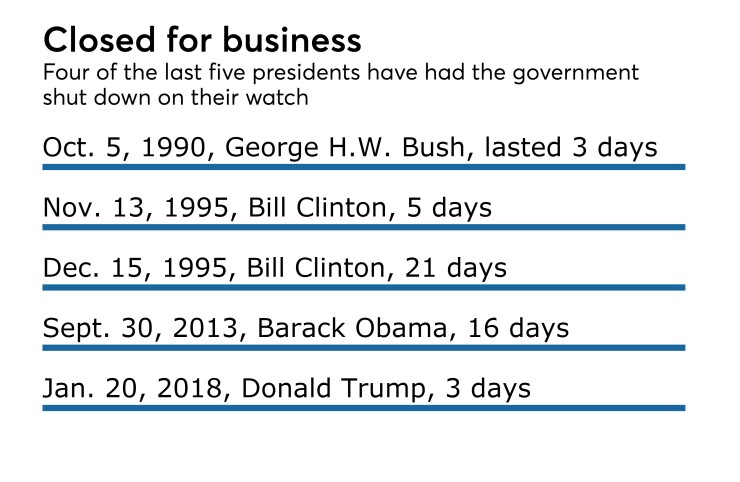

WASHINGTON — When the federal government closed its doors Friday evening, the financial world for the most part responded with indifference, but Washington’s political dysfunction may pose a bigger long-term risk to financial stability than the industry appreciates.

The federal government shut down Friday night after the Senate voted down a short-term funding bill that would have left the government open through February, but the upper chamber

Whatever the outcome of the current budget and debt ceiling fight, analysts say there is a risk in these continual battles becoming so common that banks and other institutions stop preparing for the effects of political strife on the financial system.

“Because this has become somewhat routine, I think there is a certain amount of complacency in financial markets,” said Nancy Vanden Houten, a senior economist with Oxford Economics. “The markets tend to price it in. But until we get really close, I think there’s a bit of a blasé attitude — of, ‘OK, here we go again.’ There’s definitely a risk in being complacent, and the current political environment is more unpredictable than what we’ve had before.”

Different kinds of government dysfunction affect different markets in different ways, but the main two threats are government shutdowns and threatened defaults on U.S. sovereign debt. Aaron Klein, policy director for the Center on Regulation and Markets at the Brookings Institution, said that by far the greater of the two threats is a possible breach of the debt ceiling.

“People definitely … care more about the debt ceiling than they do about government shutdowns,” Klein said. “A government shutdown has its largest impact on GDP. A Treasury default has huge ripples across the debt market.”

The U.S. has only failed to pay its debt once before, when a

The Trump administration — like the Obama administration before it — is looking for a more permanent way to avoid the anxiety that a looming credit default causes in debt markets. Treasury Secretary Steven Mnuchin said earlier this month that he and the president were working on a way to change the budget process that raises or suspends the debt ceiling at the time additional spending is authorized.

“It’s somewhat of a ridiculous process, the way we do this,” Mnuchin said. “I won’t go so far as to say that we shouldn’t have a debt limit, but I do believe that when money is authorized to be spent, there is some mechanism [whereby] the debt limit is also raised to pay for it.”

Chris Whalen, chairman of Whalen Global Advisors LLC, said one of the reasons the Treasuries market is relatively unfazed by political dysfunction — or the threat of credit default that may result from it — is that demand for U.S. sovereign debt remains high. But if Treasury auctions are less competitive and bid-ask spreads widen, then markets might become more volatile, as was the case in the 1970s.

“If we ever get to the point where the spreads widen, and the auctions are not as well-bid as they are right now, then that changes the tenor of things,” Whalen said. “But there’s been a shortage of paper for a long time. We had a record year in debt issuance last year, but the Street didn’t make any money on it.”

Vanden Houten said there is also a kind of opportunity cost associated with political dysfunction. When Congress is spending its time fighting itself, it could be passing legislation that would actually boost the economy, such as workforce education or infrastructure.

“The government could be doing a lot more to lay a better foundation under the economy,” Vanden Houten said. “There are vast ideological differences between the parties on how to approach different things, but even something like education — we could better educate our workforce. And even though markets can kind of sail along without regular order in the Congress and regular passing of budgets, it does take its toll.”

Whalen said a somewhat less visible form of political risk to the financial system is the failure of the government to pass a budget through regular order.

The government has been drifting from continuing resolution to continuing resolution for much of the past decade, Whalen said, and that prevents the government from doing the kinds of things that might put it on a firmer fiscal footing. The inability to do that has an impact on how debt purchasers value U.S. debt, he said.

“In a political sense, it makes perfect sense, but in fiscal terms, no,” Whalen said. “I think the refusal to have a process in place that they can actually follow, and … to address the long-term issues, those both count against the U.S. as a sovereign.”

Klein said that beyond debt markets, the pricing effect of a dysfunctional government is much harder to discern. A government shutdown or functional incapacity might have very limited effects on the ability of a company like United Airlines or Amazon to fulfill its day-to-day operations.

In certain instances, banks could be comparatively more reliant on a functioning government, Klein said. They do not experience many effects of a federal shutdown since the bank regulators in general operate independently of the budget process, but they could feel the effect of political and government risk in other ways.

“Different sectors rely on the government to different degrees,” Klein said. “Banks rely on the government more than other entities — they’re fundamentally chartered, not licensed by the state. Often when people talk about markets, they’re using that as a proxy for economic growth. Government is important to economic growth, but the main driver of economic growth is the private economy.”

Whalen said that political risk will always be an underappreciated systemic risk because its most acute form —a default on sovereign credit — could only happen amid a more chronic breakdown of regular order. Observers in the financial sector, as anywhere else, may not take it seriously until it is too late, he said.

“It is [a source of systemic risk], but it is one that is always receding,” Whalen said. “As long as the U.S. can fund itself, deficits and debt are not an immediate problem. It’s like