-

The Financial Stability Oversight Council has struggled to find its footing since its creation in Dodd-Frank. The Treasury secretary has signaled a more aggressive role for the panel, including reviving its authority to target nonbank behemoths.

April 8 -

The Financial Stability Oversight Council’s plan to study the market explains very little about which activities or firms, like Fannie Mae and Freddie Mac, will be designated as systemically important. Here's some clearer guidance.

July 21

-

The council created by the Dodd-Frank Act to identify systemic risks launched a review of the market as part of an activities-based approach that shifts focus away from targeting individual firms.

July 14 -

A report from the Financial Stability Oversight Council cited a bigger share of originations and servicing by nonbanks as a potential vulnerability in the financial system.

December 5 -

A report from the Financial Stability Oversight Council cited a bigger share of originations and servicing by nonbanks as a potential vulnerability in the financial system.

December 4 -

The regulators have yet to complete rules on regional bank supervision, community bank capital and other provisions meant to ease institutions' burden.

August 1 -

There is bipartisan agreement in the Senate that Fannie Mae and Freddie Mac are "too big to fail," but some lawmakers are skeptical that a SIFI designation is appropriate.

June 25 -

There's been chatter about whether the government-sponsored enterprises should be considered systemically important. But supporters must consider that such a designation would put the Fed in charge of their supervision, a step that would do more harm than good.

June 3 American Enterprise Institute

American Enterprise Institute -

The FHFA director’s recent comments about whether the government-sponsored enterprises should be designated as SIFIs tees up a potentially significant element of the mortgage finance debate.

May 24 American Banker

American Banker -

The central bank, which received broad authority after the crisis to supervise big banks, is expected to get more attention from lawmakers over its discretion to ease banks’ burden.

September 10 -

The federal bank regulators are considering roughly a dozen new rulemakings in response to the bill rolling back certain sections of Dodd-Frank.

July 20 -

The industry’s biggest legislative victory in a decade made it to the finish line Thursday.

May 24 -

The bill passed by the House took a more cautious approach to relief than prior legislative proposals but has still been hailed by banking industry groups.

May 22 -

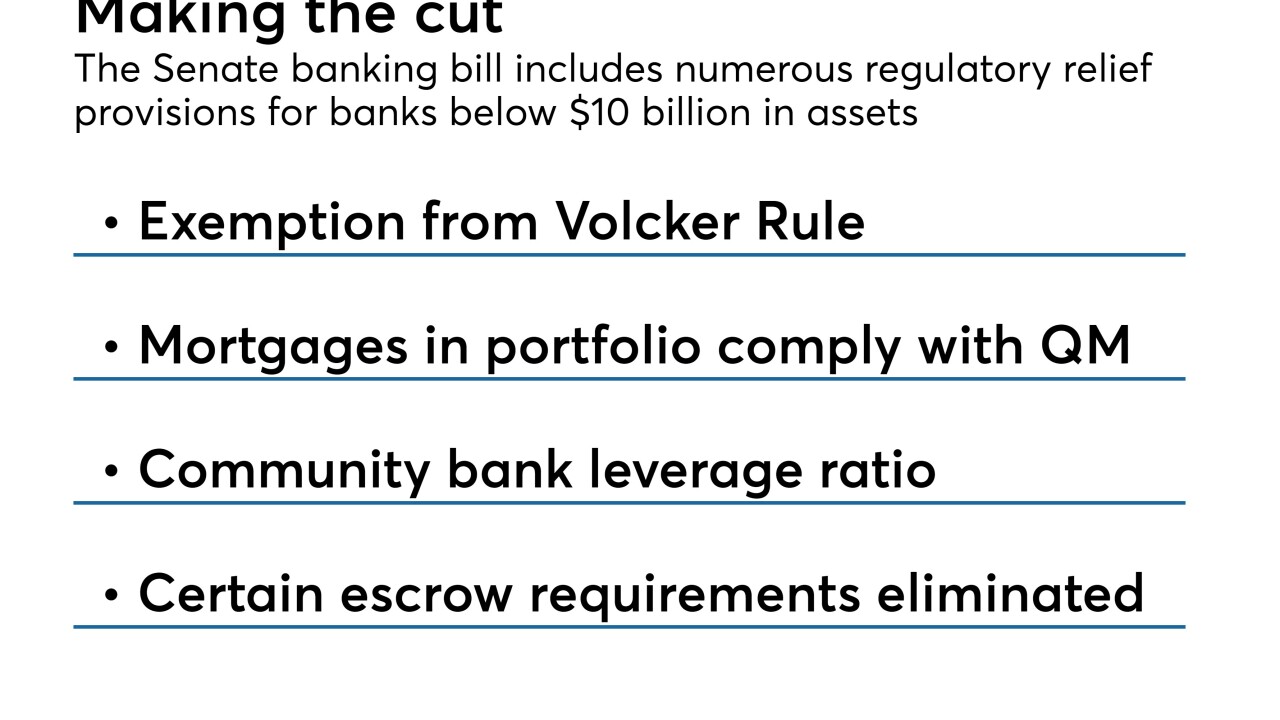

The biggest legacy of the current regulatory relief effort may be the increasing focus on whether organizing banks in supervisory buckets by asset size makes sense. Yet the bill deals with just one of the two big asset thresholds in the law.

March 26 -

While regulatory relief legislation would raise the asset threshold for “systemically important” banks, Federal Reserve Chairman Jerome Powell said the central bank could still apply prudential scrutiny to banks below that new cutoff.

March 21 -

A day after the Senate passed regulatory relief, top House Republicans vowed to have a big say in the final version before the bill heads to the White House. That raised fresh questions about how quickly the Dodd-Frank reforms will become law.

March 15 -

With the Senate finishing its work on a regulatory relief package, a showdown in the House still looms while critics of Dodd-Frank weigh whether this is their last shot at unwinding it.

March 14 -

Former Rep. Barney Frank rejected concerns voiced by other Democrats that a Senate bill rolling back some provisions of the Dodd-Frank Act will fuel another financial crisis.

March 13 -

The latest version of a bill to give regulatory relief to small institutions includes language designed to ensure that large foreign bank holding companies do not also see their supervision eased.

March 7 -

More than 50 amendments had been filed by Wednesday afternoon to be considered as part of a Senate regulatory relief bill, but it was unclear which proposed changes if any have the approval of the legislation's key sponsors.

March 7