Operation Hope Inc. and the Federal Emergency Management Agency have announced the formation of Project Restore Hope, an economic recovery initiative for Hurricane Katrina victims that includes assistance in deferring mortgage payments.The project will provide economic assistance as well as free financial counseling online, in communities housing disaster evacuees, at FEMA Disaster Recovery Centers in Louisiana, Mississippi, Alabama, and Los Angeles, and over the phone from call center facilities in Dallas and Poway, Calif. Project Restore Hope will be managed through OHI's emergency recovery division, Hope Coalition America, which is recruiting "Hope Corps volunteers" with financial and accounting backgrounds. The volunteers will provide assistance in deferring mortgage payments, working with creditors, and filing insurance claims, as well as emergency budget guidance and credit management. "FEMA has formed a relationship with Operation Hope and Hope Coalition because they offer a unique and much-needed set of services, aimed at limiting the economic impact on individuals affected by these disasters," said David Garratt, acting director of FEMA's Recovery Division. OHI can be found online at http://www.operationhope.org.

-

The mortgage broker trade group put out a white paper calling for lowering transaction costs, increasing housing supply and reducing regulatory barriers.

10h ago -

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

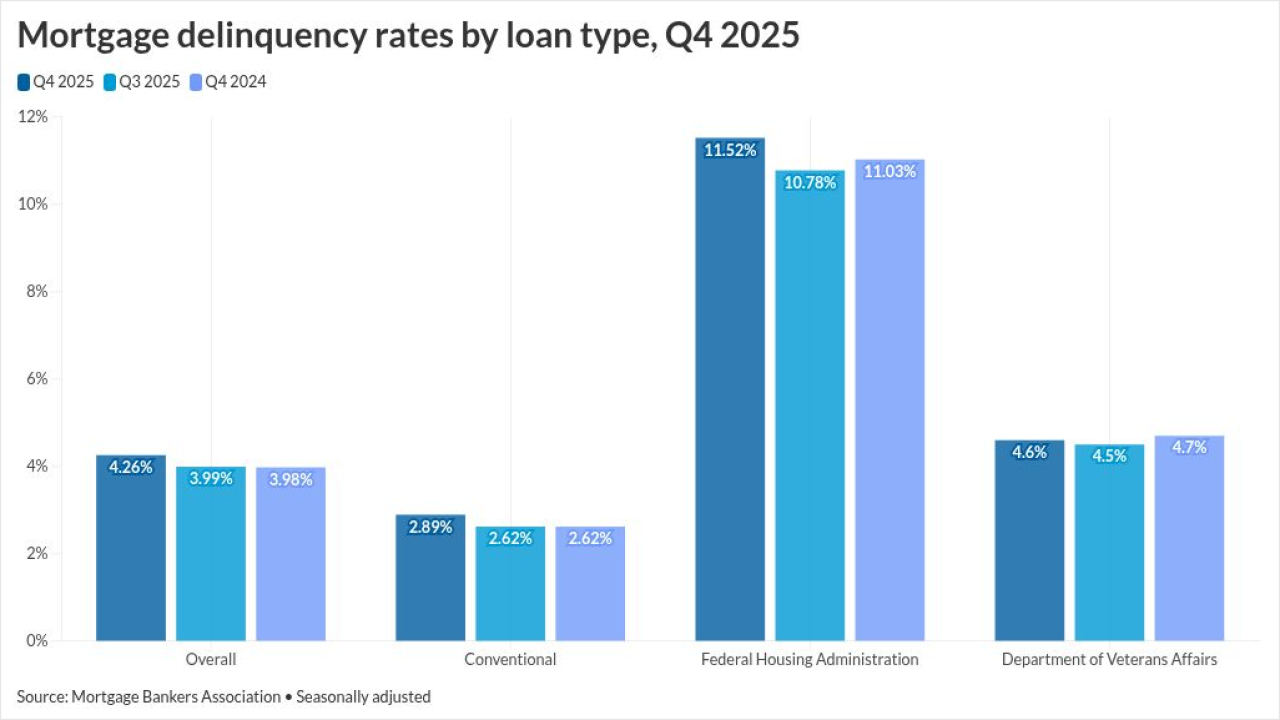

Mortgage delinquencies increased across loan types, and while 30-day late payments showed overall improvement, later-stage distress worsened.

February 13 -

The Bureau of Labor Statistics released its January Consumer Price Index Friday, showing that inflation rose 0.2%, while the annual rate eased to 2.4% after holding at 2.7% for several months. The data reduces the likelihood that the Federal Reserve will cut interest rates in the near future.

February 13 -

Hundreds of E Mortgage Capital employees, including loan officers, can opt-in to the complaint accusing the company of failing to pay them for overtime.

February 13 -

The Consumer Financial Protection Bureau's complaint portal has been flooded in recent years, but corporate debt collectors, industry attorneys and consumer advocates question whether the bureau's efforts to reduce the volume will help consumers as much as it helps the firms they're complaining about.

February 13