Thirteen classes from two Lehman manufactured housing securitizations have been downgraded by Fitch Ratings.The downgrades were as follows: class I-A-1 of Lehman ABS Corp. series 1998-1 group I, from AA to A-plus, and classes II-A-1 and II-A-2 of series 1998-1 group II, from B to B-minus; and Lehman ABS Corp. series 2001-B, classes A1 to A6, from AAA to AA, class M1, from AA to BBB-plus, class M2, from A to BB, and class B1, from BB to B-minus. Fitch also affirmed the ratings on four classes from the transactions. The downgrades in series 2001-B were attributed to deterioration in the relationship between credit enhancement and expected losses, and those in 1998-1 were attributed to the likelihood of interest shortfalls on the underlying classes. Fitch can be found online at http://www.fitchratings.com.

-

The fourth quarter results integrated the operations of both Redfin and Mr. Cooper into Rocket Cos., with the deals likely contributing to the full year loss.

9m ago -

MBS buying has become the near-term focus but a 2026 offering is still possible, Federal Housing Finance Agency official Bill Pulte told Fox Business.

27m ago -

Rocket Mortgage and Compass launched a three-year Redfin listing partnership, expanding access to 500,000+ homes, with executives saying they see no RESPA compliance issues.

45m ago -

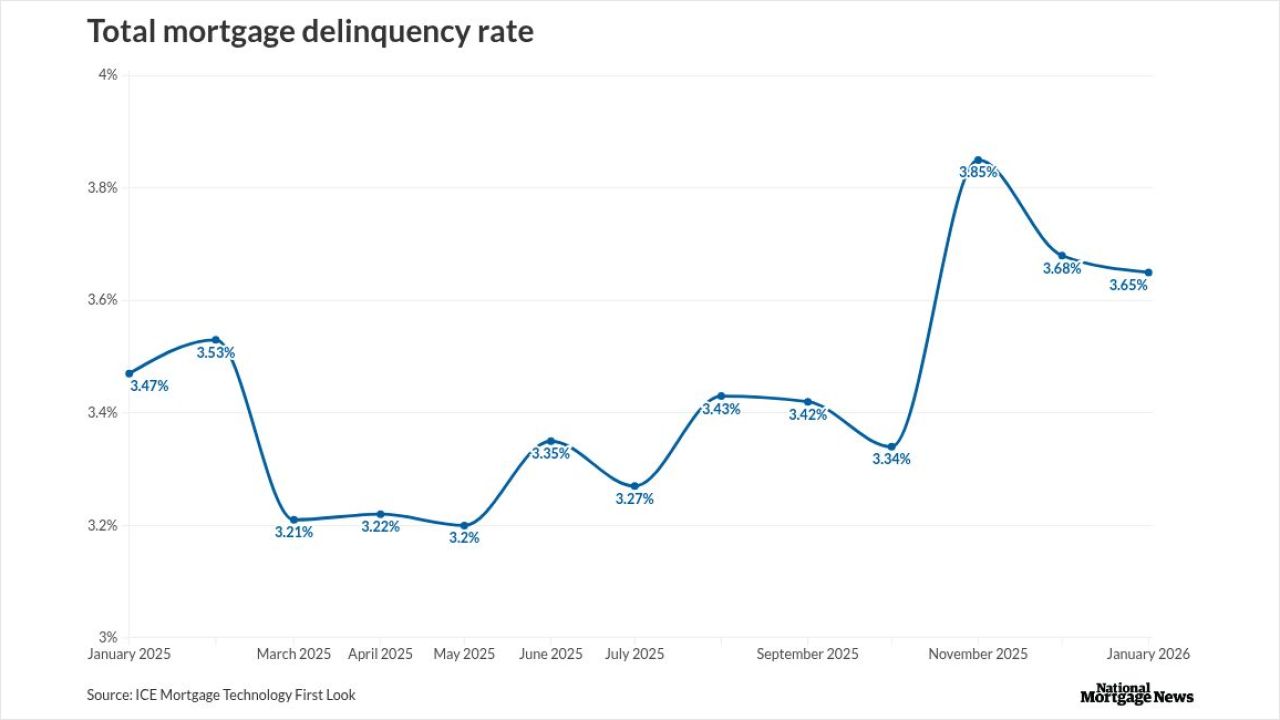

While overall delinquencies eased in January, foreclosure starts jumped to their highest point since early 2020, signaling growing strain among late-stage borrowers despite steady mortgage performance.

2h ago -

Senate Majority Leader John Thune, R-S.D., moved to consider the housing package next week, but it's not clear what version of the bill senators will be voting on as the House, Senate and White House are still negotiating priorities.

3h ago -

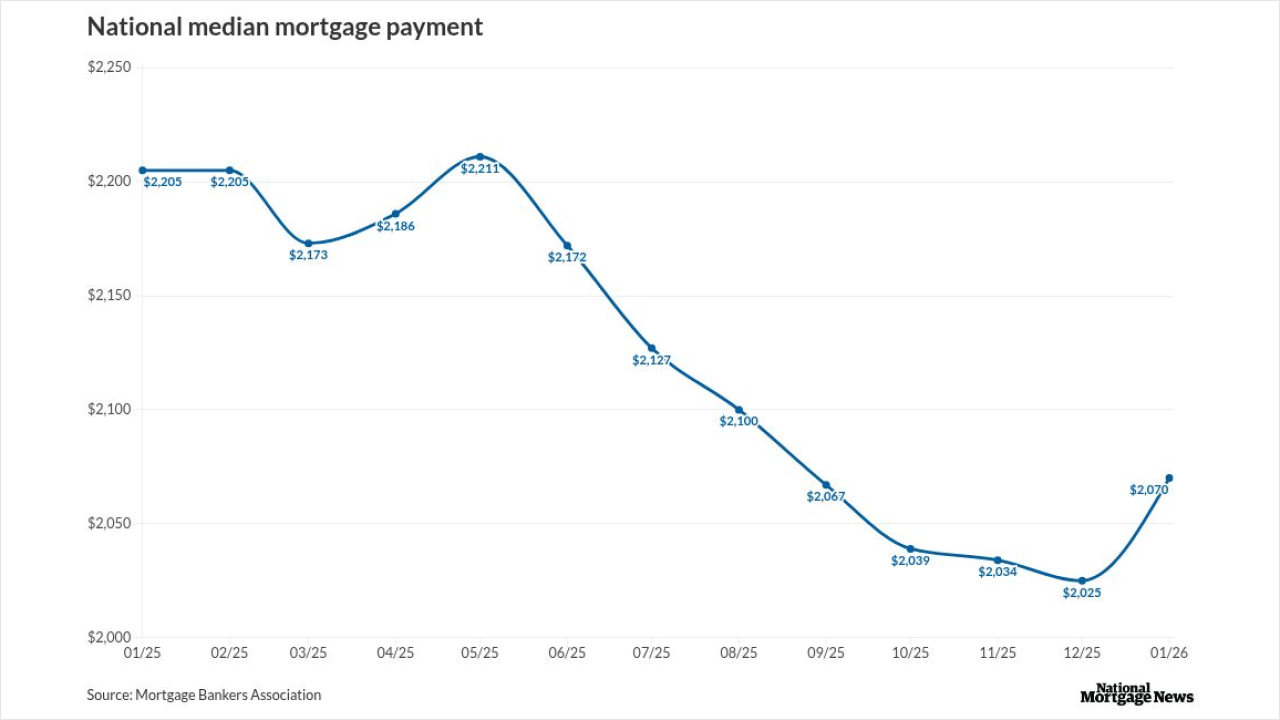

The national median payment applied for by purchase applicants rose from $2,025 in December to $2,070 last month, according to the Mortgage Bankers Association.

3h ago