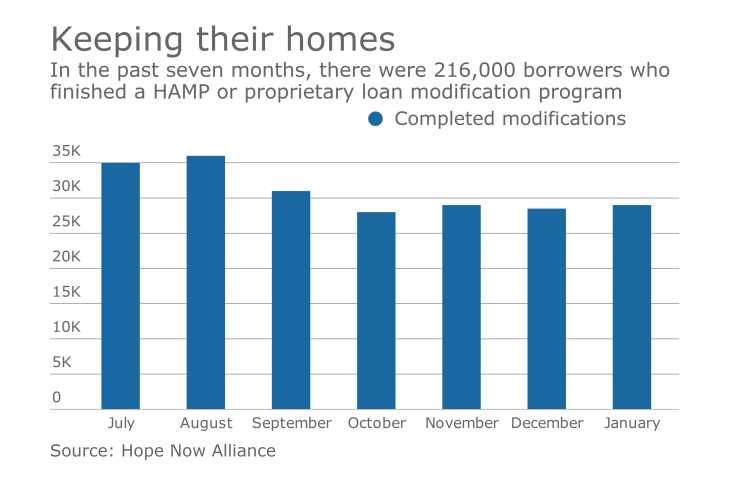

Modification activity increased slightly in January over December as servicers worked their way through the remaining Home Affordable Mortgage Program applications.

There were 29,000 permanent modifications completed in January. This was up 3% over December's 28,500, and 11% over the 26,000 modifications completed

There were 9,521 HAMP modifications completed in January, up from 9,462 in December.

HAMP expired on Dec. 31, but will be

Foreclosure starts increased by 14% to 55,000 and sales were up 34% to 26,000 in January over the previous month. That increase is being attributed to normal post-holiday seasonal patterns, Hope Now Executive Director Eric Selk said in a press release.

"Despite the increase from the previous month, starts are down 4% and sales are down 22% from January of 2016. The delinquency rate continues to decline and is now at 1.46 million serious delinquent borrowers," Selk said. "The data shows that the continued industry efforts have produced consistent results, as foreclosures continue to drop month, over month."

There were 1.5 million serious delinquent borrowers in December.

Short sales were down 12% to 3,700 while the number of deed-in-lieu of foreclosure transactions was unchanged at 1,200.