Initial earnings released by the

The company recorded $2 billion in net income and a more than 100% year-over-year gain in annual originations, outstripping the industry’s average growth, which was closer to 50% according to the Mortgage Bankers Association.

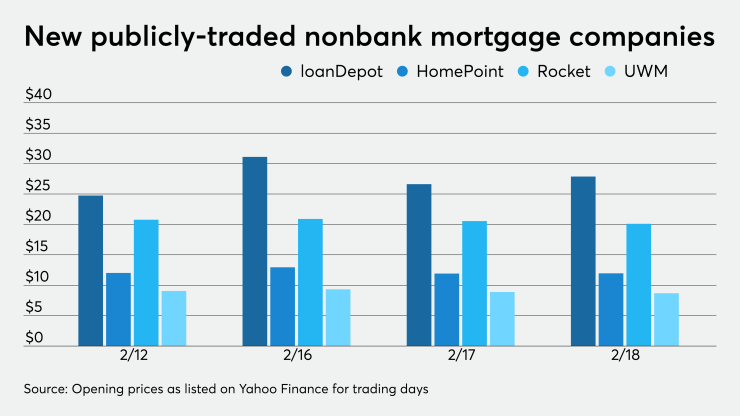

However, while its 3.38% gain-on-sale margin was up from 2.81% a year ago, it was down from 4.48% in the third quarter. Its stock price at deadline was down a little over $2 on the day of the earnings announcement, at $25.69. LoanDepot’s closest competitor among nonbank mortgage companies new to the market, Rocket Cos., has been trading at roughly $20 per share.

The thinning in the company’s margins is only relative to the extraordinary gains seen during the recent refinancing boom, and analysts and investors shouldn’t let that distract them from the more stable, long-term gains the company is positioning itself for, CEO Anthony Hsieh said.

“The industry can move dramatically and sometimes violently. But that said, although we are in a cyclical business, we are in a predictable business,” he said.

To that end, loanDepot has designed its strategies to match its competitors’ collective strengths while not putting all its eggs in one basket as some of them have, Hsieh added.

For example, the company is diversifying its sources of purchase lending by expanding its business relationships with builders.

That’s important because the mortgage industry traditionally counts on the more predictable purchase market to sustain it when refinancing fluctuates, and currently opportunities in the homebuyer market are limited primarily by inventory. Applications for mortgage financing on new homes were up nearly 19% from a year ago and 17% from

To be sure, the new-home market is relatively small. Some builders have their own in-house mortgage units, and there are limits to construction growth, which drove

That’s why builder outreach is just one of many loan product channels the company will be relying on to keep itself competitive, Hsieh said, pointing to its focus on a wholesale unit, more traditional branch network, a digital mortgage channel and a servicing retention unit.