Commercial and multifamily loan performance in March was its best in nearly one year, but there was a slight month-to-month uptick in payments missed in the short-term, the Mortgage Bankers Association reported.

A 95% share of commercial and multifamily loans as measured by balance due were current on their payments in March, up from 94.8% in February, according to the MBA's CREF Loan Performance Survey.

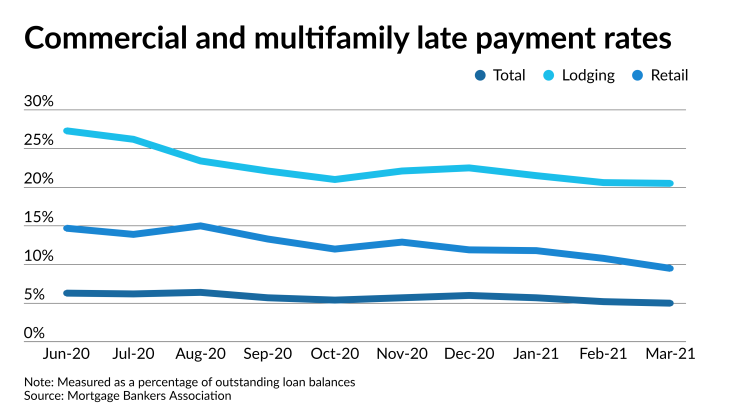

"Commercial and multifamily mortgage delinquencies fell for the third straight month in March and are now at their lowest level since the pandemic disrupted the economy and commercial real estate a year ago," Jamie Woodwell, the MBA's vice president of commercial real estate research, said in a press release. "There continues to be significant differences in loan performance by property type, with higher delinquencies rates for lodging- and retail-backed mortgages."

The largest share of commercial mortgages in March was those without a payment being made in 90 days or more, or are now real estate owned, at 3.2%. This was down from 3.5% in February. Last August, the first month for which the MBA provided this data, a 2.9% share of loans that had missed at least 3 months of payments.

About 0.3% of loans were between 60 days and 90 days late, unchanged from February, and 0.5% of loans were between 30 and 60 days late, down from 0.6% the month before.

But the second largest grouping of overdue March loans were those for which a borrower missed the due date but was still less than 30 days late, at 0.9%, up from 0.8% in February.

Even though lodging and retail remain the segments most affected by the pandemic, delinquency rates for loans secured by these properties improved over February.

For lodging loans, 20.5% as measured by outstanding balances, were late in March, down from 20.6% the previous month.

Retail showed better improvement, at 9.5%, down from 10.8% in February.

Industrial property also had a significant change in the share of late payments, down to 1.2% in March from 2.7% one month prior.

Office properties not current on their payments remained at 2.4% compared with February, while multifamily loans that were late increased to 1.8% in March from 1.7% the month before.

By investor type,

Payments were not current on 8.7% of loans in CMBS in March, but this was down from 9.3% in February.

According to a separate report

In March 2020, the last month of relatively normal economic activity, the CMBS delinquency rate was 2.07%. The highest ever delinquency rate

Lodging loans in CMBS had a 16.38% delinquency rate in March, down from 19.19% in February, but well above the 1.6% in March 2020, Trepp reported. For retail, March's delinquency rate of 11.83% was an improvement over February's 12.68%; in March 2020 it was 3.62%.

Among other major investor types, 2.1% of multifamily and health care property mortgages insured by the Federal Housing Administration were late in March, down from 2.7% the prior month, the MBA report said.

The late payment rate for life insurer mortgages was 1.6% in March, down from 2% and for Fannie Mae and Freddie Mac loans it was 1.2%, compared with 1.3% in February.