Millennials flooded the mortgage market to refinance on lower rates, but the industry couldn't manage activity as quickly,

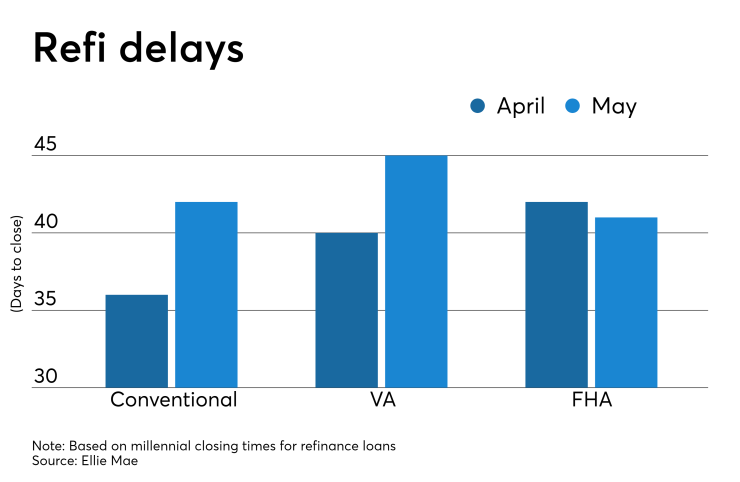

The average 30-year note rate dropped from 4.61% in April to 4.53% in May, the lowest it fell since February 2018. Elevated refi levels (as a result of the lower rate) prolonged closing times by six days to 42 in May

"Refinance activity amongst millennials continued to rise as interest rates dropped," Joe Tyrrell, chief operating officer at Ellie Mae, said in a press release. "Time to close has been trending downward recently, but in May, the volume of activity pushed the mortgage finance industry to a tipping point where it spiked dramatically. As the digitization of the mortgage process continues to evolve, increased automation will help borrowers and lenders close all loan types more efficiently, even during periods of increased activity."

While more raced to refi in May, the share of overall refinances ticked down to 14% from 15% in April due to the competitive spring market. The time to close a purchase loan was unaffected, and held steady at 40 days.

The average millennial FICO score held steady at 721 — the exact

About 71% of mortgages closed in May were conventional, while 25% were