Digital servicing strategies have reduced the number of calls mortgage companies handle, particularly amid the pandemic, however, the extent to which that has reduced the need for people to staff the phones has been limited, a Standard & Poor’s study finds.

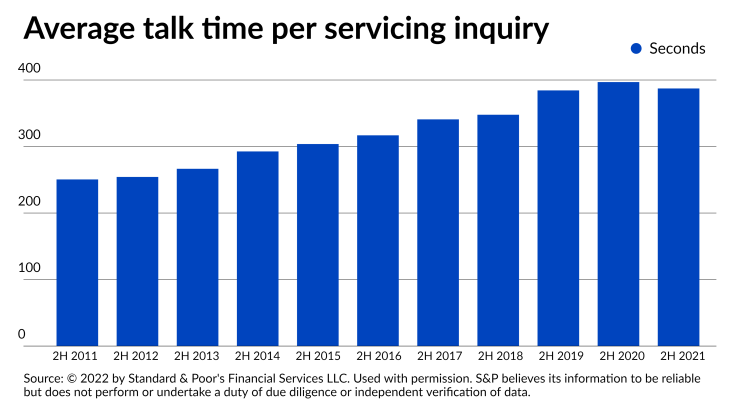

The number of calls per loan in the past two years fell by 23% thanks in part to automation and consumers’ increased willingness to use it, but time on the phone during the same period lengthened by around 22% as it became relegated to use for more complex inquiries.

The report largely confirms similar numbers from sources like the Mortgage Bankers Association, which have suggested that social distancing and forbearance policies put in place during the pandemic boosted call time and the use of technology.

However, the S&P report additionally finds that the two trends were in effect even prior to 2020, suggesting these patterns will persist beyond it as well.

Servicers’ website registration rate started at just over 41% in the first half of 2011 and generally rose over the years. It plateaued around 68% in the second half of 2021. Average talk time for call centers followed a similar trajectory, rising from around 250.5 seconds to around 387.3.

“We’ll see what happens, but I think the longer call times will stay, in my view,” said Leigh Stafford McLean, a credit analyst at S&P Global. “Because borrowers are going to be able to continue to get information for the easy inquiries, I don’t think we’ll be seeing much lessening of that number even though it may not increase as much as we’ve seen over the last five years.”

Increased development of servicing technology will likely persist as well, depending on whether current

“We’re still seeing servicers continue to build out some of the technology,” said Jason Riche, who also is a credit analyst at S&P Global. “One of the things we’re starting to see is the use of data and intelligence to try to identify when borrowers may call, so information can be pushed out to them to further limit the calls coming in.”

While digital servicing is expected to continue making headway, challenges remain, a report released Wednesday by First American’s venture capital arm, Parker89 stated.

“Servicing has historically been people- and process-oriented versus technology oriented,” Nate Levin, managing director at Parker89, said in an email. He added that servicing also has a lot of legacy technology that can be challenging to upgrade or replace.

Where call centers are concerned, efforts to get borrowers to self-serve by anticipating their needs and proactively offering them information are making headway, but as statistics show, they still don’t work all of the time, in part because predictive analytics are in their infancy in the mortgage space, said Bob Caruso, CEO at

“Many customers still prefer to call even if they have to talk to an interactive voice response system,” said Caruso, whose company is owned by First American.

Interactive voice response tech has helped bridge the gap between online self-serve technologies and live phone calls, Standard & Poor’s study shows. The capture rate for calls into voice response units has risen from nearly 38% in the first half of 2011 to more than 52% in the last six months of 2021.

While technology that servicers use to more efficiently handle customer inquiries will keep evolving, it might not be as much of a priority with the reduction in refinancing and forbearance volumes.

“Loss mitigation is a key area of focus, but there are many other foundational elements that are more pressing,” said Levin.

These include middleware that is an interim solution to difficulties upgrading legacy systems, compliance and more efficient payment collection, remittance and reconciliation.

“For example, technology support for compliance with state regulations is almost non-existent. Also, real workflow that automates activity and exceptions is very limited,” Caruso said.