Mortgage application

The MBA's Market Composite Index, which measures weekly application volumes through surveys of the trade group's members, increased a seasonally adjusted 1.1% from seven days earlier. The rise was near par with the 0.9% rise in the previous survey, but activity came in 25% lower compared to the same period last year.

The latest uptick came as interest rates,

The average of the contract 30-year fixed mortgage with balances conforming to Fannie Mae and Freddie Mac specifications tumbled 20 basis points to 6.87% from 7.07%. Borrower points dropped to 0.66 from 0.74 for 80% loan-to-value ratio loans.

Meanwhile, the 30-year fixed jumbo average for loan balances above conforming the limit, which is $726,200 in most markets, also retreated 15 basis points to 6.89% from 7.04% one week prior. Points used increased to 0.64 from 0.59.

Reluctant sellers limiting purchase supply volume

The leading theme dictating the home buying market over the past several months is the paltry level of inventory available, characterized by consumers opting to stay put instead of move in order to avoid the current level of interest rates that would come along with relocation.

"Home purchase activity is still being held back by low housing supply and rates that are still much higher than a year ago," Kan said.

Last week, the MBA's seasonally adjusted Purchase Index slipped a seasonally adjusted 1.3% from the prior survey. But compared to the same period in 2022, purchase volumes sat 21.5% lower.

Several recent studies point to the extent of reluctance to sell among homeowners. Earlier this week, Redfin determined the

A survey conducted by Credit Karma also found nearly a quarter of homeowners who planned to sell within the next three years said they may hold off and remain in a smaller space to allow interest rates to fall. A similar share said they would consider temporarily moving into an affordable rental and becoming landlords of their current properties in order to hold on to the favorable rates they already held.

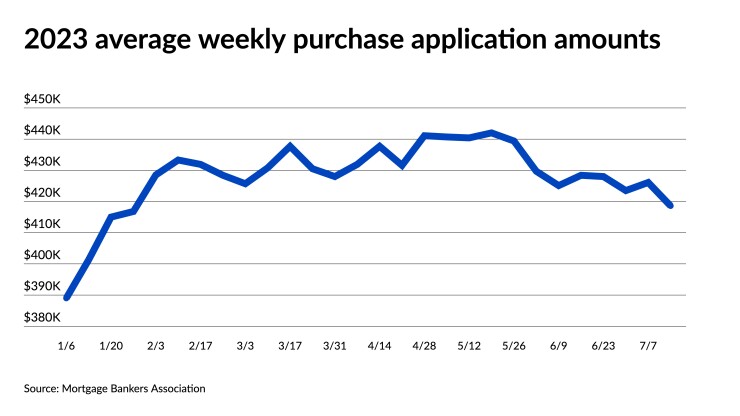

However, average purchase amounts on new applications continued its slow retreat seen since the beginning of June, according to MBA's survey. Last week, the mean size took another step back to $418,600, the most affordable level since late January, dropping 1.8% from $426,100 seven days earlier. In comparison, the average size stood at $439,400 in late May.

Countering the decrease, though, was the average refinance-application amount, which swung higher by 1.2% to land at $257,900 compared to $254,900 seven days earlier. But the overall average across all loans applied for last week ended up lower, sitting at $372,900, down 1.9% from $380,200.

Refis surge, while government activity inches up

Meanwhile, a surge in refinances offset falling purchase activity. The Refinance Index climbed up for the first in three weeks, up by 7.3% from the prior survey period. The share of refinances relative to overall volume also grew to 28.4%, up from 26.8%. Despite the weekly gain, activity remained 31.9% slower than its pace of 12 months ago.

Federally sponsored loan volume remained mostly flat, with the seasonally adjusted Government Index inching up 0.4%. Government applications still managed to take a similar-sized slice of activity compared to the previous week. Federal Housing Administration-backed applications made up 13.6%, increasing from 13.3%, but the share of Department of Veterans Affairs-guaranteed mortgages dropped to 12.1% from 12.6%. Applications coming from the U.S. Department of Agriculture garnered a 0.5% share, edging up from 0.4%

ARMs go up, as fixed-rates fall

As the conforming and jumbo averages fell, so did other fixed interest rates. The 30-year FHA-backed mortgage average headed down to 6.77% from 6.86%, with borrower points also decreasing to 1.12 from 1.23.

The 15-year fixed-rate contract average likewise dropped, but by a smaller degree to 6.36% from 6.42% a week earlier, while borrower points fell off by 50 basis points to 0.72 from 1.22 for 80% LTV loans.

Meanwhile, the 5/1 adjustable-rate mortgage, which offers a fixed term for 60 months before becoming variable, bucked the trend by climbing 3 basis points higher to 6.27% from 6.24% week over week. The ARM share of activity compared to overall volume shrunk to 6.3% after increasing to 6.6% a week earlier.