Want unlimited access to top ideas and insights?

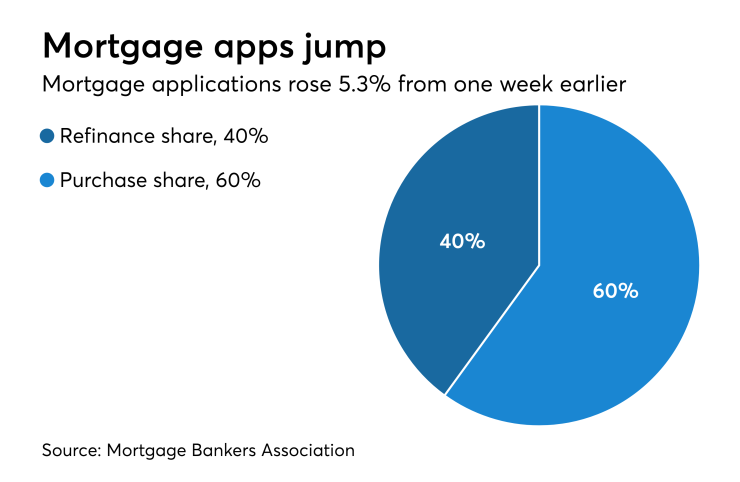

Mortgage applications increased 5.3% from one week earlier, as the stable rate environment enticed homebuyers into the market, according to the Mortgage Bankers Association.

"Mortgage rates were little changed last week, but as we anticipated, homebuyers are responding favorably to this more stable rate environment," Mike Fratantoni, the MBA's senior vice president and chief economist, said in a press release. "Purchase applications for both conventional and government loans rose last week, with the government gain led by a 14% increase in applications for VA purchase loans."

The MBA's Weekly Mortgage Applications Survey for the week ending Feb. 22, 2019 found the seasonally adjusted purchase index increased 6%

The unadjusted purchase index decreased 1% compared with the previous week and was 3% higher than the same week one year ago.

The refinance share of mortgage activity decreased to 40.4% of total applications from 41.7% the previous week.

However, refinance application volume was up 5%, "with the index reaching its highest level in a month," Fratantoni said. "Borrowers with larger loans tend to be more responsive for a given drop in rates, and competition for these loans is fierce. Therefore, it was not surprising to see the average rate for a 30-year fixed jumbo loan drop to its lowest level since January 2018."

Adjustable-rate loan activity decreased to 7.3% from 7.7% of total applications, while the share of Federal Housing Administration-guaranteed loans remained unchanged from 10.2% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 10.7% from 10.1% and the U.S. Department of Agriculture/Rural Development share decreased to 0.6% from 0.7% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased 1 basis point to 4.65%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $484,350), the average contract rate decreased 16 basis points to 4.4%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased 4 basis points to 4.64%. For 15-year fixed-rate mortgages, the average decreased 4 basis points to 4%. The average contract interest rate for 5/1 ARMs decreased 5 basis points to 3.95%.