Mortgage applications increased 6.8% from one week earlier as this summer's surprise purchase demand has carried over to the fall, according to the Mortgage Bankers Association.

But it was not just purchase that grew as the MBA's Weekly Mortgage Applications Survey for the week ending Sept. 18 found that the refinance index increased 9%

And all this happened as rates rose to their highest point in several weeks.

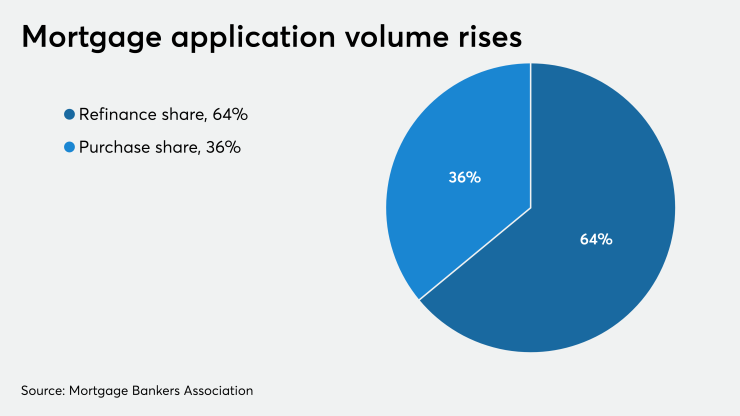

The refinance share of mortgage activity increased to 64.3% of total applications from 62.8% the previous week.

Meanwhile, the seasonally adjusted purchase index increased 3% from one week earlier, while the unadjusted purchase index increased 13% compared with the previous week and was 25% higher than the same week one year ago.

"Mortgage application activity remained strong last week, even as the 30-year fixed-rate mortgage and 15-year fixed-rate mortgage increased to their highest levels since late August," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "Purchase applications were up over 25% from a year ago, and the demand for higher-balance loans pushed the average purchase loan size to another record high. The strong interest in home buying observed this summer has carried over to the fall."

"Despite the uptick in rates, refinance applications increased around 9%. Both conventional and government refinance activity, and in particular FHA refinances, picked up last week."

Adjustable-rate mortgage activity decreased to 2.2% from 2.3% total applications, while the share of Federal Housing Administration-insured loan applications increased to 10.1% from 9.7% the week prior.

Meanwhile, the share of applications for Veterans Affairs-guaranteed loans decreased to 12% from 12.3% and the U.S. Department of Agriculture/Rural Development share increased to 0.6% from 0.5% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased 3 basis points to 3.1%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400), the average contract rate decreased 6 basis points to 3.35%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased 7 basis points to 3.23%. For 15-year fixed-rate mortgages, the average increased 3 basis points to 2.64%. The average contract interest rate for 5/1 ARMs decreased 1 basis point to 3.19%.