Larger mortgage companies are paying less than other creditors when fraud occurs, but the expense is still detracting enough from their revenue to cause concern.

Bigger digital mortgage firms are paying $3.27 for every $1 of fraud, while other digital creditors in the same size range are paying $3.47, according to LexisNexis Risk Solutions' 2018 True Cost of Fraud report.

Also, digital mortgage firms that earn $50 million or more in revenue annually also are experiencing fraud attempts at just half the rate equivalent digital creditors are.

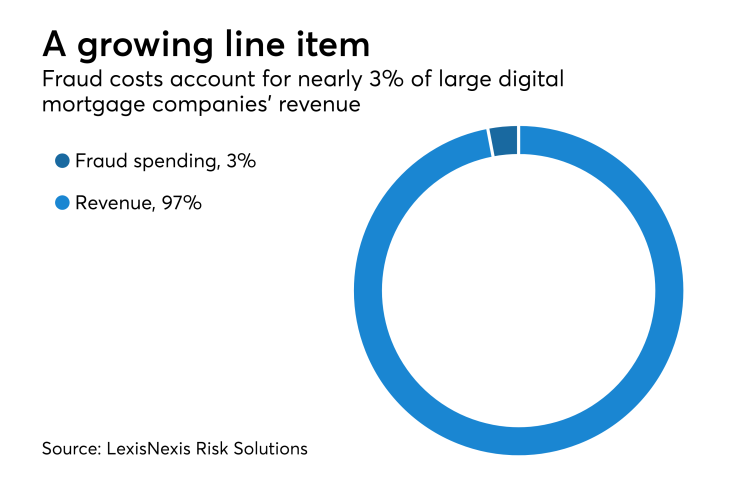

But large mortgage companies' fraud-related spending is still a high-enough percentage of revenue on average that they are starting to take more notice of it.

A large mortgage lender that generates at least half of its business remotely, for example, typically spends almost 3% of its revenue on costs related to fraud.

"The mobile channels seem to be driving much of this," according to the report. "With higher fraud through mobile web browsers and third party and branded mobile apps, identity verification is cited as the top challenge with the mobile channel."

Because expenses related to digital channel exposure to fraud can be high, bigger lenders and servicers in the mortgage industry are spending more on cybersecurity, according to Kevin Brungardt, CEO of RoundPoint Mortgage.

"Especially for larger servicers, what's really striking now is the cost that's associated with the appropriate cybersecurity infrastructure," he said in an interview. "As a cost, it used to be something that was almost immaterial. It's become a budget item now."