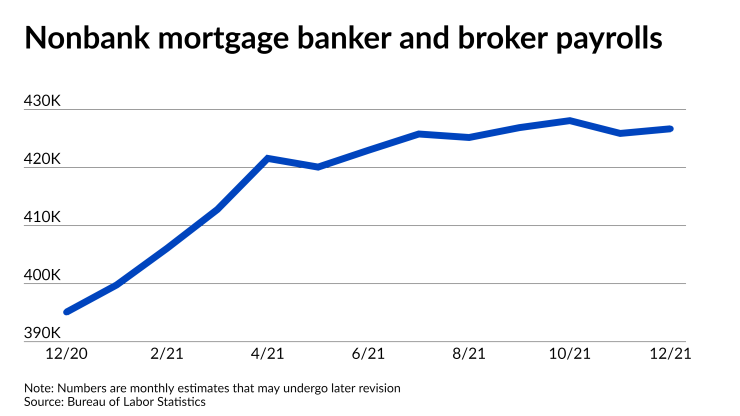

The latest nonbank mortgage employment numbers show a slight month-to-month uptick, but even after a substantial upward revision for 2021 following an annual review, hiring is plateauing.

The monthly payroll estimate for non-depositories, which reflects mortgage banker and broker employment in December 2021, was up at 426,700, compared to 425,900

Collectively, these numbers suggest that interest in home purchases is bearing up well despite some limits on consumer spending and normalization in the mortgage market after two banner years.

“The increase in the labor force participation rate is positive in that it shows that employment still has room to run,” said Mike Fratantoni, chief economist at the Mortgage Bankers Association, in an emailed statement.

“Average hourly earnings are up 5.7% over the year,” Fratantoni added, noting that while this is below the pace of inflation, he expects that “rising wages will support housing demand this year.”

One subset of the latest job numbers also points to signs that the tight housing inventory of recent years could improve during 2022, according to Fannie Mae Chief Economist Doug Duncan.

“The residential construction sector (including specialty trade contractors) saw job growth of 4,400 in January, higher than December’s pace, which we believe will help to alleviate supply constraints in this sector,” he said.

Job growth in this sector has exceeded what was seen pre-pandemic, in contrast to some other business sectors that still haven’t fully recovered.

“Residential construction employment currently exceeds its level in February 2020 while 67% of nonresidential construction jobs lost in March and April have now been recovered,” noted Jing Fu, director of forecasting and analysis at the National Association of Home Builders, in a blog.

Although the construction industry and other job gains are likely to sustain housing market activity and purchase lending, they also support monetary policy aims, which could prop up diminishing refinancing activity.

“With the Fed expressing satisfaction with employment trends, this reading will most likely solidify plans to raise rates and

That means that, even with a relatively strong economy and housing market, some mortgage companies may have to readjust their staffing or employees to account for changes in their business mix as refis dwindle, if they haven’t already. Companies like

That said, refinancing’s recent tendency to come in at levels stronger than what was originally forecast could prompt some mortgage companies to be conservative about staff cuts so long as their normalizing finances allow it.

“We were forecasting [more refinancing] than anyone…in that space and even so we were not optimistic enough … last year,” Fannie Mae’s Duncan said in a recent interview. “It’s the hardest part of the market to forecast because it's purely a consumer option.”