The latest employment estimates for non-depositories in the housing finance industry softened in line with

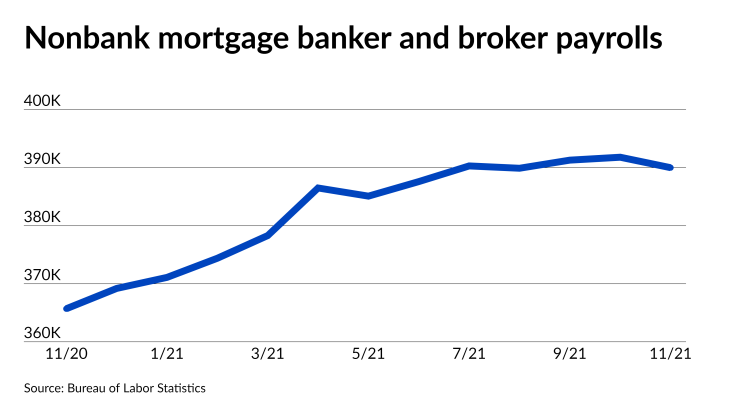

The number of people on mortgage banker and broker payrolls in November fell to 390,000 from an upwardly revised 391,800, according to the Bureau of Labor Statistics. Total U.S. jobs, which are reported with less of a lag, rose by 199,000 in December, coming in below consensus estimates and November’s addition of 210,000 positions. Despite the weak employment gains in the broader market, unemployment fell to 3.9% in December from 4.2% the previous month on an unadjusted basis. When adjusted for an ongoing misclassification error, unemployment was 0.1% higher than reported in the last two months.

Overall, the BLS numbers generally suggest that while the job market is a lot better off than it was a year ago,

Unemployment could be key to what happens next in housing finance as it will likely play a key role in monetary policy decisions about interest rates, noted Mike Fratantoni, senior vice president and chief economist at the Mortgage Bankers Association.

“MBA forecasts that the unemployment rate will decrease to 3.5% by the end of 2022, which is in line with recent Federal Reserve projections and would support a more rapid normalization of interest rates this year,” he said in an emailed statement.

The housing market’s strength and supply conditions in the face of strong demand will partially determine how much hiring nonbank lenders will do going forward. That might not be clear until spring, when the winter slowdown typically ends.

“Residential construction (including specialty trade contractors) posted a decline of over 4,000 jobs in December compared to gains in recent months, which we expect will do little to ease supply constraints,” said Fannie Mae Chief Economist Doug Duncan in an emailed statement.