The mortgage industry is eager to adopt digital strategies like artificial intelligence to streamline processes, but they are finding it difficult to extend through the full lifecycle of the loan.

While on one hand mortgage lenders are extracting rich, comprehensive data, many are then just converting the information into a PDF and shipping it off, explained Blend product manager Grace Qi at the Mortgage Bankers Association Technology Conference on Tuesday in Dallas.

More than two-thirds of surveyed attendees at the MBA conference believe the digital mortgage is already possible, but actually implementing the technology is a different story.

Origination volume has been down and costs per loan are rising, forcing companies to get creative and determine how to not only craft a simpler process, but also remain profitable.

Vendors nevertheless believe they can sell innovative technologies this year.

"The industry at large is absolutely in the place of disruption; 2019 is going to be one of the most important years in the innovation phase," said Brent Chandler, FormFree's founder and CEO.

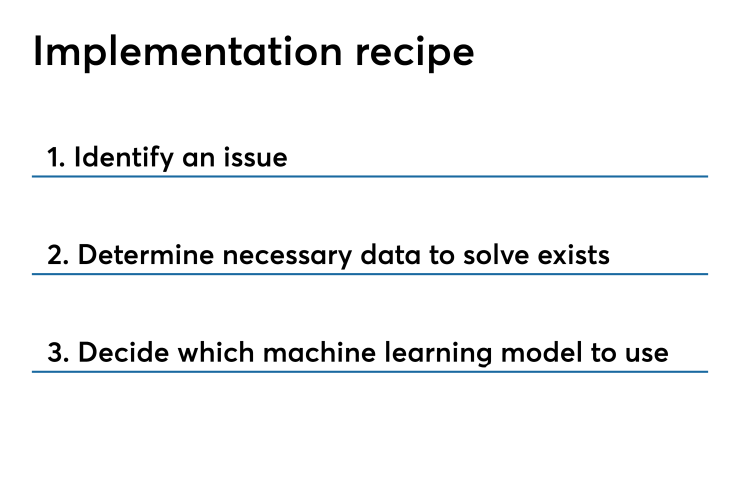

The following formula can help institutions reach a successful technology implementation: identify a problem, determine whether they have the necessary data to settle the issue and then decide which machine learning model to use, according to David Frost, director of commercial mortgage servicing technology at Wells Fargo.

As companies take tech steps forward, they can't lean on one overall model or particular application to solve for all of its issues. While one tool may be responsible for extracting data, another is likely required to facilitate it through another piece of the mortgage value chain.

Businesses looking to build a better overall process could actually benefit from taking a step back and assessing their digital foundation. While a tool like optical character recognition (which converts images of words to machine-encoded text) is not the end point in an environment where machine learning exists, companies shouldn't necessarily skip to the finish line, said Brian Fitzpatrick, CEO at LoanLogics.

"I think that everybody thinks they have to immediately go to the end state of machine learning or AI, before they’ve exhausted the use of those other evolutionary technologies," said Fitzpatrick.

"OCR is a starting point," he explained. "In the machine learning world, all it's doing is taking the data of the document, we just have no idea what the data means. And that's where the machine learning algorithms come in — where the algorithms are essentially creating context of that data that's why machine learning is really an evolution of technology, as is AI; it's the 'what' versus the 'how.'"

When drilling down use cases for machine learning and AI, companies should focus on data-related applications. While these tech resources can better streamline the human judgment piece of the process, it will always require the involvement of people to some extent.

"Human judgment is not going to go away, whereas machine learning hasn't really scratched the surface is on the other 90-plus percent of the process, which is actually very manually and repetitive, and very ripe for this," said Qi.