Despite a slight rise in interest rates, the percentage of

Overall closing rates rose from 70.6% in July to 71.7% in August, the highest level closing rates have been since January 2017.

Interest rates ticked up to 4.27%, sitting just above their 2017 low of 4.25% in July.

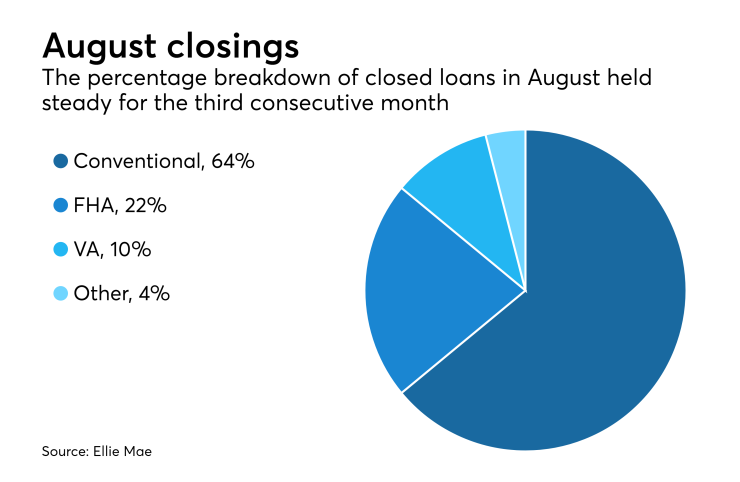

The percentage breakdown of all closed loans in August held steady for the third consecutive month with conventional loans making up 64% of all closed loans and Federal Housing Administration loans comprising 22% of loans closed. U.S. Department of Veterans Affairs loans represented 10% of all closed loans.

The movement of

About 71% of purchase loans had FICO scores over 700 and 67% of refinance loans had scores over 700. Regarding all loan types, approximately 70% of closed loans had FICO scores over 700.

The average closing time for all loan types decreased to 42 days in August; the time to close a refinance loan inched down to 41 days from 42 in July, and the average time to close a purchase loan remained at 43 days in August.