Mortgage interest rates headed upward for the first time in four weeks, as markets tried to make sense of what recent comments from Fed officials might mean for borrowers and lenders in the near term.

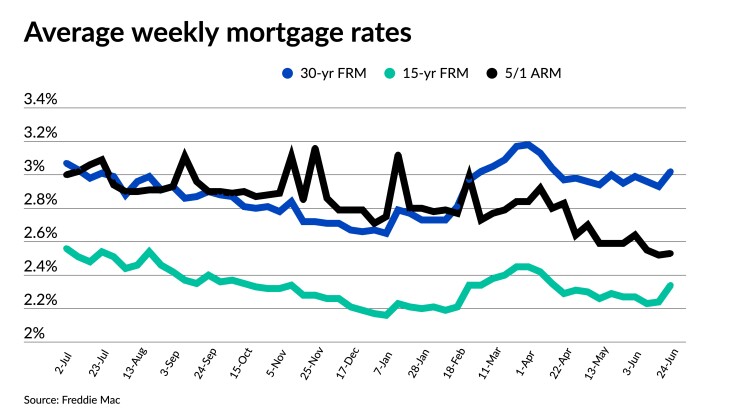

According to Freddie Mac’s Primary Mortgage Market Survey, the 30-year fixed-rate mortgage came in at 3.02% for the weekly period ending June 24, the first time since mid April that the 30-year landed above 3%. The average rate stood at 2.93%

Treasury yields jumped almost immediately following last week’s meeting of the

“While shorter-term Treasury yields continued to climb in the days following the announcement, the upward momentum in longer-term yields — which generally dictate the path of mortgage rates — faded, and yields turned back downward, at one point touching their lowest levels in months,” said Zillow economist Matthew Speakman. ”Mortgage rates didn’t fall by quite as much, instead leveling off for the remainder of the week.”

According to Speakman, a more hawkish tone from some officials may have helped apply downward pressure on the yields influencing mortgage rates.

Fed Chair Jerome Powell insisted since the start of the pandemic that federal interest rate hikes would not come into play until the economy showed sufficient signs of recovery, including a sustained 2% inflation rate and low unemployment. But with

Other central bank leaders, including Fed Governor Michelle Bowman and Atlanta Fed President Raphael Bostic shared the same sentiment recently, with the caveat that the transitory phase may last longer than many first anticipated. In separate interviews over the past week, regional central bank officials, including Bostic, Dallas Fed President Robert Kaplan and St. Louis Fed President James Bullard, all stated they anticipate the first rate hike to arrive as soon as 2022.

Last week’s Fed announcement likely set the groundwork for mortgage rates to begin climbing, and the window may soon close for homeowners who have yet to take advantage of current conditions, said Freddie Mac chief economist Sam Khater. The first half of 2021 has seen

“As the economy progresses and inflation remains elevated, we expect that rates will continue to gradually rise in the second half of the year,” Khater said. “For those homeowners who have not yet refinanced — and there remain many borrowers who could benefit from doing so — now is the time.”

With the 30-year fixed-rate mortgage rising to its highest level in over two months, the 15-year fixed rate also showed a similar jump, up 10 basis points to 2.34% from 2.24% a week earlier. In the same week one year ago, the rate was at 2.59%.

The 5-year Treasury-indexed adjustable-rate mortgage average also posted an increase, inching upwards to 2.53% from 2.52% the prior week. One year ago, the 5-year ARM averaged 3.08%.