Mortgage rates headed up for the fifth week in a row, as investors await

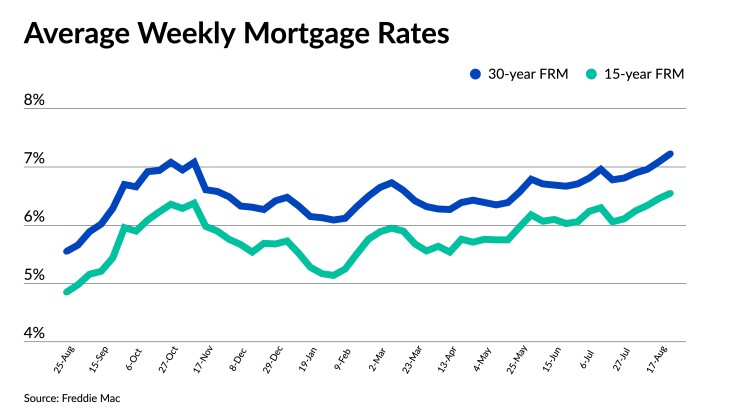

The 30-year fixed-rate came in at an average of 7.23% for the seven-day period ending Aug. 24,

With volatility and unpredictability driving 10-year Treasury yields higher this year, many economists see few signs of a retreat that might provide hopeful news to lenders and consumers looking for relief in the near future. Mortgage rates generally move in tandem with the direction of Treasuries.

"This week, the 30-year fixed-rate mortgage reached its highest level since 2001, and indications of ongoing economic strength will likely continue to keep upward pressure on rates in the short-term," said Sam Khater, Freddie Mac's chief economist, in a press release.

The 15-year mortgage rate also jumped to an average of 6.55%, a 9 basis point jump from 6.46% a week earlier. In the same Freddie Mac survey 12 months ago, it landed at 4.85%.

The latest movements come even as 10-year yields actually decreased from 4.31% at the close of trading on Aug 17 to 4.22% on Aug. 24. But within much of that period, they climbed as high as 4.34%, pushing mortgage rates higher, before leveling off on Wednesday.

Similarly noting the effect of "stronger-than-expected" economic data in recent months was Orphe Divounguy, senior macroeconomist at Zillow Home Loans, who said that "rising risks of higher inflation have continued to cause longer term yields and mortgage rates to move higher."

While the past few months of moderating inflation gave rise to

The Fed chair's words "have the potential of either assuaging growing concerns in the housing market, or further fueling the disequilibrium from which, there was still some hope, we could begin to reemerge this year," according to Dan Burnett, head of investor product at Hometap Equity Partners, a Boston-based residential real estate investment platform.

"A more aggressive posture will only serve to prolong pressures on a housing ecosystem already fatigued by historically low inventory and borrowing costs at multi-decade highs," Burnett added in an analyst note.

Also bracing for the potential of higher rates after Friday was the Zillow economist. "Signals that Chair Powell believes that more monetary policy tightening is needed in order to further stem inflation will likely push Treasury yields — and the mortgage rates that follow them — up even further," Divounguy said in a research statement.