Mortgage rates edged up slightly over the past week on the heels of recent economic developments and updated central bank guidance.

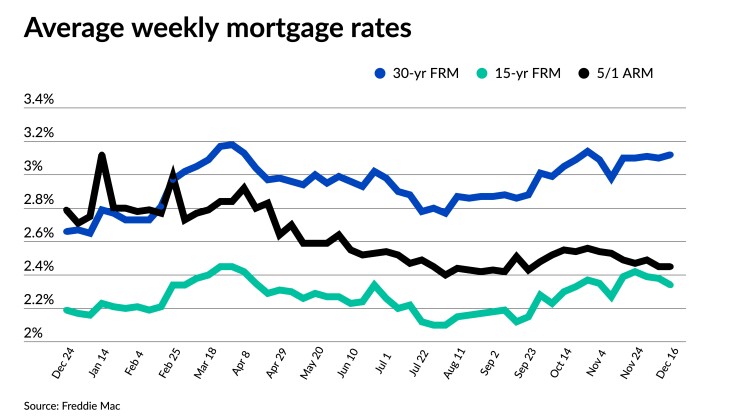

The 30-year fixed-rate mortgage averaged 3.12% for the weekly period ending Dec.16, rising two basis points from 3.1% seven days earlier, according to the latest Freddie Mac Primary Mortgage Market Survey. The current average came in 45 bps above the rate from the same week a year ago, 2.67%.

The rate movement over the past few weeks has provided few surprises, some industry experts said.

“Rates have remained relatively steady over the past month, continuing to tick up gradually overall, which was to be expected based on the tapering of interest rates by the Federal Reserve,” said Robert Heck, vice president of mortgage at online mortgage marketplace Morty, in a statement sent to National Mortgage News.

“Through December, which should see this gradual increase continue, which represents a return to more realistic rates that reflect what we saw in the years prior to the pandemic,” he added.

For consumers, the news means higher mortgage rates and unpredictability are on the horizon throughout 2022, according to the Mortgage Bankers Association.

“Going forward, MBA forecasts that mortgage rates will rise to 4% by the end of 2022 and may be more volatile as the Fed backs away from the market,” said Mike Fratantoni, the MBA’s senior vice president and chief economist, in a press release.

“Although this will lead to a drop in refinances, we expect that the strong economy will support an increase in home sales in 2022,” he added.

Sam Khater, Freddie Mac chief economist, similarly predicted rising rates as well as continued elevated home costs for the coming year. “While house price growth is slowing, prices remain high due to solid housing demand and low supply. We expect rates to continue to increase into 2022 which may leave some potential homebuyers with less room in their budgets on the sideline.”

While the 30-year average rate increased, the 15-year fixed-rate headed downward over the past week to 2.34% from 2.38%. The 15-year average in the same week one year ago was 2.21%.

The 5-year Treasury-indexed adjustable-rate mortgage averaged 2.45%, unchanged from the previous week. In the same seven-day period of 2020, the 5-year ARM rate came in at 2.79%.