The 30-year fixed-rate mortgage jumped by almost a quarter of a percent, with economists now hinting that the likelihood of further increases could finally slow the pace of home sales.

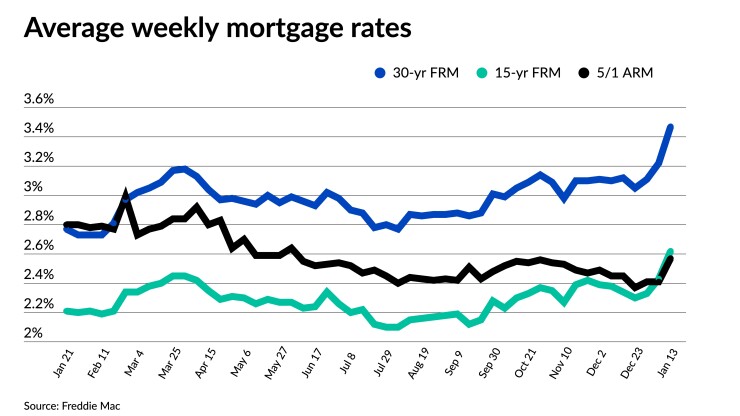

Rates climbed across all categories, with the 30-year average coming in at 3.45% for the weekly period ending Jan. 13, according to the Freddie Mac Primary Mortgage Market Survey.

The swift rise was “was driven by the prospect of a faster than expected tightening of monetary policy in response to continued inflation exacerbated by uncertainty in labor and supply chains,” according to Sam Khater, Freddie Mac’s chief economist.

“With the latest unemployment rate, many market participants believe this gives the Fed more room to focus on addressing inflation concerns as labor markets are near full employment levels,” said Paul Thomas, Zillow vice president of capital markets, in a research blog post.

The news has the potential to throw cold water on a

Additional

“Markets now appear to be anticipating an initial Fed rate hike in March, with a likely cumulative rate increase of 75-100 basis points 2022,” added Thomas.

In December, the

While the jump was not as large as for the 30-year mortgage, the 15-year fixed-rate average hit its highest point since summer 2020, rising 19 basis points to 2.62%, compared to 2.43% a week earlier. One year ago, the 15-year average sat at 2.23%.

And after averaging 2.41% for two consecutive weeks, the 5-year Treasury-indexed adjustable-rate mortgage also headed up, climbing to 2.57%. In the same week of 2021, the 5-year ARM stood at 3.12%.