At many banks, mortgage revenue took a hit in the second quarter as last year’s crush of refinancing activity ended, and stronger competition led to lower margins on the sale of loans.

Falling interest rates in recent weeks may reverse some of the pressure, encouraging more homeowners to refinance and continue to fuel demand for new home purchases. But last quarter’s softer mortgage revenues are an indication that the record-setting figures in the second half of 2020 were an outlier, according to bankers and analysts.

“We essentially are returning to more normal times in mortgage,” said Jim Mabry, chief financial officer at the $16 billion-asset Renasant Corp. in Mississippi, where net gains on mortgage loan sales fell by nearly half in the second quarter.

Mortgage revenues fell between April and June at bigger and smaller banks alike. At JPMorgan Chase, mortgage fees slid from $704 million in the first quarter to $551 million, which was roughly half of what the megabank reported in the third quarter of 2020. At Citizens Financial Group, the percentage decrease

And at Columbus, Georgia-based Synovus Financial, mortgage banking income slowed to $13.84 million, down from $22.3 million in the first quarter and from $31.23 million in the third quarter of 2020.

The decline at Synovus stemmed partly from the fact the $15.2 billion-asset bank has been holding more mortgage loans on its books instead of selling them into the secondary market, where Fannie Mae and Freddie Mac are dominant, but private-label securitizers also snap up loans to package and sell to investors. Another factor: Synovus fetched smaller gains on the loan sales it did make, executives said.

“It’s a very competitive marketplace,” Kevin Blair, the president and chief operating officer at Synovus, told analysts on an earnings call. “That’s an area that we expect to continue to see some pressure.”

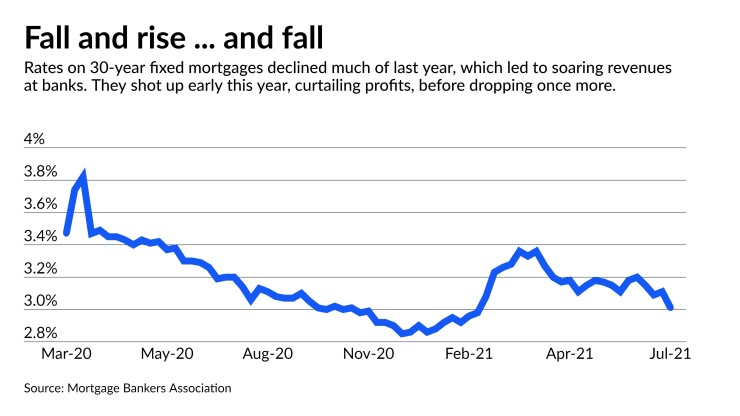

During the second quarter, fewer homeowners refinanced their loans as interest rates rose, leading to smaller origination volumes for banks.

Reduced demand for refinancing helped lead to “outsized amount of competition” among lenders — particularly the nonbanks that dominate the refi market — and pinched banks’ margins as they lowered prices in order to attract business, said Kevin Barker, managing director at Piper Sandler.

The pressure may be easing somewhat. Rates have fallen recently as the delta variant of COVID-19 clouds the economic outlook and helps push investors into bonds, lifting their prices and lowering their yields.

After rising sharply early this year from record lows, the weekly average 30-year fixed-rate mortgage hit a peak of 3.18% on April 1 and has mostly fallen over the past month. The average rate on a 30-year fixed mortgage dropped to around 2.80% in the week ending July 29, according to

Refinancing activity has been “going gangbusters” recently, with borrowers who missed out last year getting another chance to refinance at ultra-low rates, according to Marina Walsh, vice president of industry research at the Mortgage Bankers Association.

The group’s weekly refinance index, which has mostly declined this year,

Despite the recent decline in rates, it is “hard to break a record every year,” and many homeowners have already taken advantage of refinancing, said John Toohig, a managing director at Raymond James who helps facilitate loan sales.

For now, the chief financial officers at banks are struggling to decide whether to sell fewer loans into the secondary market, where they can earn upfront fee income, or hang onto them for a bit longer and earn interest income gradually, Toohig said. He noted that a deposit glut at banks has contributed to a need to redeploy cash and generate interest income.

“But at the same time, they also need that fee income — that gain on sale income — as quick as they can get it,” he said. “So CFOs are in real conflict in their minds on 'which way do I go’ right now.”