Ellington Financial, in a bid

Currently, Ellington has a reverse mortgage servicing portfolio from its controlling interest in Longbridge Financial, which it picked up from

Arlington has approximately $13 billion of conforming MSRs at a weighted average coupon of 3.13%.

"We believe that the benefits of this acquisition include greater operating efficiencies, a larger market capitalization, and attractive long-term unsecured debt and preferred equity capital," said Laurence Penn, Ellington's CEO and president, in a press release. "Upon closing, we believe that we will be positioned well to drive accretive earnings growth and provide strategic and financial benefits to our stockholders."

Certain MSR buyers are looking at low coupon packages, a recent panel at the Mortgage Bankers Association' Secondary and Capital Markets Conference said.

Ellington is

"As of quarter end, Arlington's MSR portfolio had 0.1 times leverage; so there is significant untapped financing available for the MSR," Bose George, an analyst with Keefe, Bruyette & Woods, said in a report. KBW served as Ellington's financial advisor for the transaction."Management noted that the deal will kick start EFC's entry into the forward MSR business."

A bullet point in Ellington's presentation for the deal stated that slightly differently, declaring Arlington's conventional servicing portfolio would facilitate its "entry into complementary new business, [sic] at scale."

"We like how the deal gives Ellington a seamless entry point into becoming an MSR investor, and it also scoops up $120 million of unsecured debt and preferred stock at a low implied valuation," said Eric Hagen, an analyst at BTIG, in a report. "We see some potential read-thru for additional M&A in areas of our coverage where valuations are deeply discounted, and we believe both near- and longer-term value can be unlocked from a deal."

Arlington also has investments in commercial real estate loans and CMBS.

Both companies are structured as real estate investment trusts.

The imputed valuation of the transaction is based on Ellington's closing stock price on May 26 at $12.92 per share. It would issue 11.7 million new shares to Arlington's holders; in addition, $3 million in cash would come from Ellington's external manager, Ellington Financial Management. The latter will keep this role after the deal closes. Arlington is internally managed.

Hagen sees fewer barriers for other internally managed REITs to be acquired, such as Broadmark, Capstead and CYS.

"On one hand, we think

Arlington was likely preparing for a potential sale, given that it divested some of its assets, including its "modest footprint" in the single-family rental lending business, Hagen said.

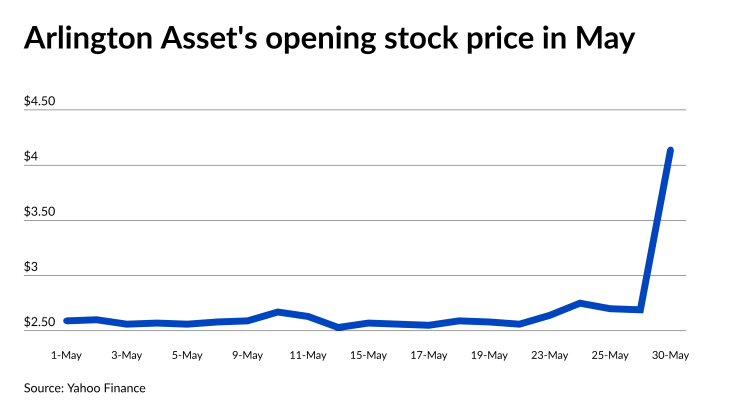

For each Arlington share that offer translates into $4.68 in stock and 9 cents in cash, well in excess of its May 26 closing price of $2.75 per share. It also comes weeks after Arlington touched its 52-week low at $2.53 per share on May 16.

Based on those May 26 prices, this combination has a pro forma market capitalization of approximately $1 billion.

On May 30, Arlington opened at $4.14 per share and Ellington at $12.50. In 2013, Arlington

After the deal closes, the combination will retain the Ellington Financial brand and ticker symbol.

Arlington Asset Investment became a stand-alone operation in

"We are thrilled to combine AAIC with the Ellington Financial team to make a combined company that we believe will be positioned to take advantage of opportunities into the future," said J. Rock Tonkel, Jr., Arlington's CEO. "This transaction combines two complementary portfolios, and we look forward to working closely with the Ellington Financial team to complete the acquisition and deliver value for our stockholders."

After the deal closes, the management team will come from Ellington, with Penn remaining as CEO and president, Michael Vranos and Mark Tecotzky, the co-chief investment officers and JR Herlihy, chief financial officer, keeping those posts.

Arlington will get one representative on Ellington's board.

In addition to KBW, Vinson & Elkins was Ellington's legal advisor. For Arlington, Wells Fargo Securities was the financial advisor and Hunton Andrews Kurth, the legal advisor.

The transaction should close in the fourth quarter.