Rising interest rates contributed to a slowdown in new mortgage applications, creating the steepest decline in weekly volume in months, according to the latest data from the Mortgage Bankers Association.

The Market Composite Index, which tracks application volume through a survey of MBA members, fell a seasonally adjusted 6.9% for the period ending June 25. On an unadjusted basis, the decrease came in at 7%. The seasonally adjusted volume was 15.8% lower compared to the same week one year ago.

“Mortgage application volume fell to the lowest level in almost a year and a half, with declines in both refinance and purchase applications,” said Mike Fratantoni, MBA’s senior vice president and chief economist.

The Purchase Index registered 5% lower on a seasonally adjusted basis from

Although volumes fell across the board, the average purchase loan size grew for the first time in six weeks, up 1.6% to $405,000 from $398,700 the previous week. But the average dollar amount of refinance applications declined 2.4% week over week to $297,700 from $305,200, pulling the average size of total mortgage applications overall 0.5% lower, to $338,600 from $340,200.

The increase of the purchase-loan average despite fewer applications could spell disappointment among first-time home buyers, according to Fratantoni.

“Purchase applications for conventional loans declined last week to the lowest level since last May,” he said. A corresponding larger purchase average meant that first-time buyers, who typically get smaller loans, “are likely getting squeezed out of the market due to the lack of entry-level homes for sale.”

The change in the conforming 30-year fixed mortgage rate also may have influenced volumes. “Mortgage rates were volatile last week, as investors tried to gauge upcoming moves by the Federal Reserve amidst several divergent signals, including rising inflation, mixed job market data, strong consumer spending and a supply-constrained housing market that has led to rapid home-price growth,” Fratantoni said.

Other recent data seemed to underscore the effect of unaffordability on potential buyers in the current market. The

Refinances and ARMs take smaller overall share

The refinance share of applications took a smaller slice of the mortgage pie compared to the previous week, accounting for 61.9% of total volume, down from 62.5%.

The share of adjustable-rate mortgage applications also decreased, falling to 3.6% from 3.9%.

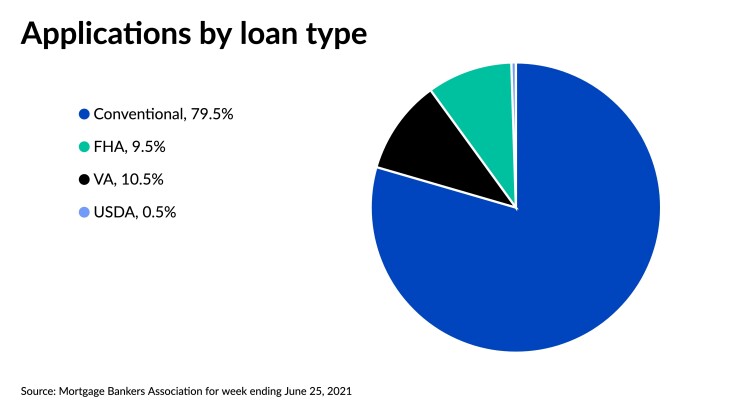

Among government-sponsored programs, the share of Federal Housing Authority-backed mortgages remained at the same level week over week, at 9.5% of total volume, but the Veterans Administration share fell to 10.5% from 11.2% a week earlier. The share of loans taken through U.S. Department of Agriculture programs saw no change, staying at 0.5%.

30-year conforming rate rises again, but jumbo rate falls

- The average contract interest rate of 30-year fixed-rate mortgages with conforming loan balances of $548,250 climbed for a second consecutive week, up to 3.20%, compared to 3.18% a week earlier.

- The average contract interest rate of 30-year fixed-rate jumbo loans (with balances greater than $548,250) dropped to 3.23% from 3.26% the prior week.

- The average contract interest rate of 30-year fixed-rate mortgages backed by the Federal Housing Authority also decreased, down two basis points to 3.19%. A week earlier, the average came in at 3.21%.

- The contract interest rate average of 15-year fixed-rate mortgages declined to 2.56%, compared to 2.58% the previous week.

- The interest rate for 5/1 adjustable-rate mortgages moved upward, climbing to 2.98% from 2.69% a week earlier.