As origination margins continue to compress, some lenders are looking to sell bulk mortgage servicing rights portfolios to make up for the lost income.

Mr. Cooper intends to be an opportunistic buyer of those MSRs over the next year, executives said on its third quarter earnings call.

"As we've been expecting for several months now, the bulk market is starting to present us with more sizable opportunities," Chris Marshall, vice chairman, president and chief financial officer, commented. "Pricing pressure is putting pressure on originators’ cash flow, which is causing them to sell MSRs more in line with normal practice."

Mr. Cooper expects to be in a great position to grow its portfolio over the next four-to-five quarters. The company has previously stated its goal is to have a $1 trillion portfolio.

The Dallas-based company reported third quarter net income of $299 million, down from $439 million in

Among the items affecting the third quarter results were a $7 million gain from the

Besides the sale of the valuations and title businesses, Mr. Cooper also sold

"These are profitable and well managed businesses so in one regard, we were sorry to see them go," said Jay Bray, chairman and CEO. "We made these decisions in order to focus on growth opportunities in our core mortgage business, which we believe are substantial." Those sales also generated cash book value gains that strengthened Mr. Cooper's balance sheet.

Mr. Cooper's servicing business had operating pretax income of $197 million, including a mark-to-market benefit of $153 million due to higher interest rates at quarter end. This compared with losses in the second quarter of $56 million and $32 million one year ago.

As part of the same corporate streamlining that led to the Xome unit divestitures, Mr. Cooper sold its $16 billion reverse MSR portfolio to

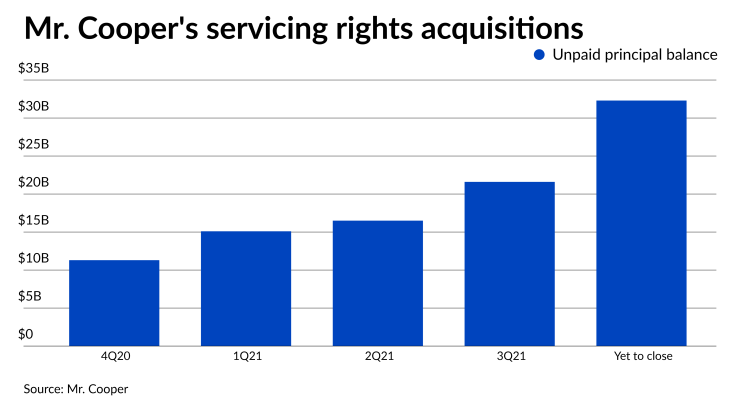

Still, it ended the quarter with $668 billion in MSRs, up from $654 billion on June 30. That includes $21.6 billion in MSR acquisitions in the third quarter, compared with $16.5 billion in the second quarter. Also, Mr. Cooper has an additional $32.3 billion of MSR purchases initiated in the third quarter that have yet to close.

On the originations side, Mr. Cooper funded $19.9 billion during the third quarter. This is down from $22.2 billion quarter-to-quarter but up from $15.6 billion year-over-year.

Pretax operating income for the originations segment was $273 million, which included a $20 million boost as a direct result of the Federal Housing Finance Agency's decision to

In the second quarter, the originations segment had $213 million of pretax operating income, while in the third quarter of 2020, when it benefited from strong gain on sales, it had $438 million.

Total net gain on mortgage loans held for sale was $430 million in the third quarter, up from $385 million in the second quarter, but down from $605 million one year prior.

While the company would not issue formal guidance on gain on sale, Marshall commented, "I expected more compression this quarter and I certainly think we'll see more compression next quarter. I would just not go further than that."

Recent rightsizing actions by Mr. Cooper will result in related charges of between $5 to 10 million in the fourth quarter, Marshall said. Originations segment earnings before taxes are projected to be between $150 million and $175 million as it expects to originate between $16 billion and $20 billion.

"Our commitment to attractive returns and a super strong balance sheet are non-negotiable," Bray said. "We expect to generate returns on equity in most environments between 12% and 20%, and we will operate with a capital ratio measure as tangible net worth to assets with at least 15%."