Want unlimited access to top ideas and insights?

High property values and low mortgage rates pushed commercial and multifamily originations

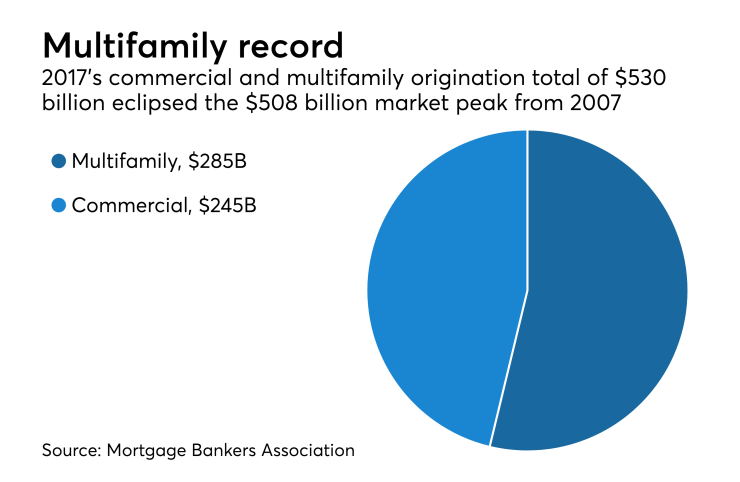

Overall, commercial and multifamily loans totaled $530 billion in 2017, breaking the previous record of nearly $508 billion from 2007. While the new record wasn't a surprise, it overshot estimates by $15 billion.

Multifamily lending drove the total by reaching a new high itself. It jumped 6% year-over-year, rising to $285 billion in 2017 from $269.2 billion in 2016, despite the number of loans dropping to 44,623 from 46,575.

"The multifamily lending market in 2017 benefited from improving fundamentals, rising property values and low interest rates," Jamie Woodwell, the MBA's vice president of commercial real estate research, said in a press release.

"The result was larger loan sizes and record levels of overall borrowing and lending. The market remains well served, with 2,554 lenders last year making loans backed by multifamily rental properties. Demand came from borrowers and lenders of all sizes, with loan amounts ranging from thousands of dollars to hundreds of millions," Woodwell said.

Wells Fargo, CBRE Capital Markets and JPMorgan Chase were 2017's leading multifamily lenders in total dollar volume. They combine to account for 19.7% of all multifamily volume last year.

Commercial and multifamily loan volume has steadily trended up since the housing crisis, with three of the highest four totals occurring in the past three years. Origination volume for 2018 should see similar results to last year, according to previous projections.