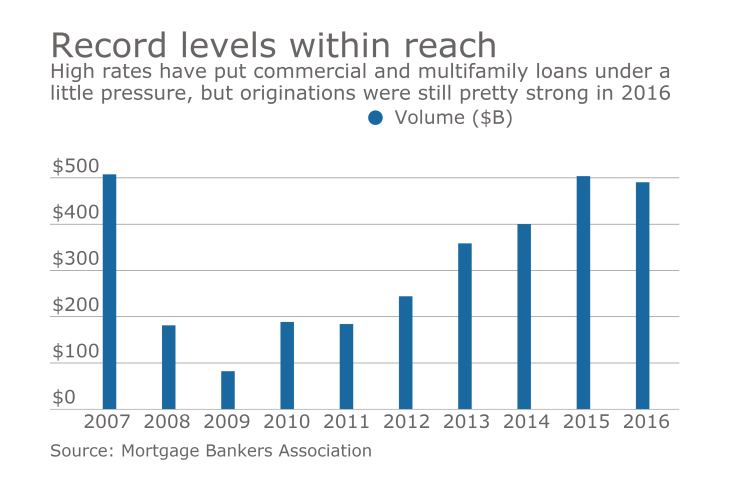

Commercial and multifamily mortgage bankers originated $490.6 billion closed loans in 2016, making it the third strongest year on record despite the pressure higher rates have put on volume.

"Last year was a strong year for commercial real estate finance," said Jamie Woodwell, the Mortgage Bankers Association's vice president for commercial real estate research, in a press release.

Only 2007 and 2015 were stronger. Volumes were 3% higher those years, with 2015 volumes coming in at a point just below the market's peak in 2007.

Early indicators in the first quarter of 2017 suggest that higher rates since the November elections have reduced some of the market's momentum, but there are other factors at play this year that make the future direction of lending on income-producing properties tough to predict.

"The degree to which [rates] and other potential market changes — such as tax reform proposals, general economic growth, foreign investment and consumer confidence — will affect borrowers and lending in 2017 is still to be seen," said Woodwell.

The MBA in February

Mortgages backed by multifamily properties made up the largest share of multifamily and commercial originations in 2016.

"Fannie Mae and Freddie Mac drove much of that activity," said Woodwell. Multifamily origination volumes totaled $214.1 billion during the year.

Commercial banks were the leading investors in the market last year, responsible for $157.4 billion of the total.