Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

The rate of single-family construction has not returned to healthy levels following its collapse during the financial crisis, and will likely continue to trend below a 1-million-unit annual pace until 2022 or later, according to a Pulsenomics and Zillow's joint Home Price Expectations Survey. Some of the most pessimistic responses claim this result is as far away as 2029.

A persistently low rate of new construction activity will continue upward pressure on house values as homebuyers battle it out for a limited number of supply. This prevents certain consumers from pursuing homeownership, which also increases costs to rent.

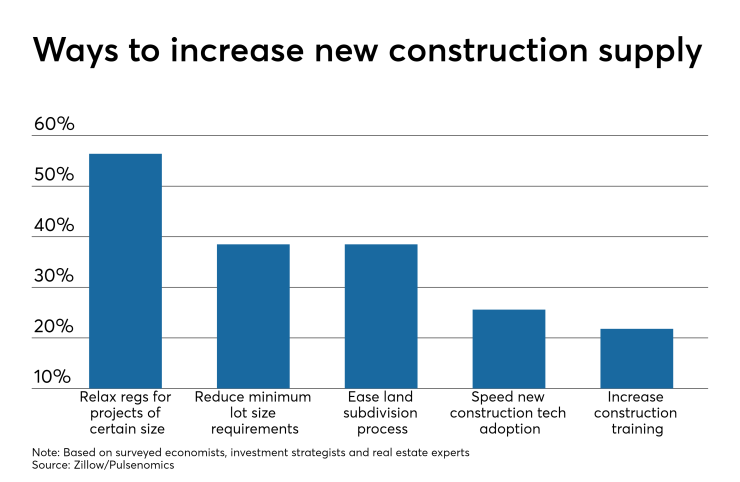

Ways to reduce homebuilding restrictions emerged as the most common theme among surveyor ideas to increase the flow of new construction on the market. This included concepts like relaxing local review regulations for projects of a certain size, shrinking mandatory minimum lot sizes and easing the land subdivision process.

"The American housing landscape was shaped in a big way by the drive for the classic American dream; swaths of cities were set aside solely for single-family, detached homes, with big minimum lot sizes and slow local review processes. Jump ahead three decades and

"Those same practices now arguably limit the ability of the next generation to become homeowners. Without new homes to meet population growth and replace an aging housing stock, home buying is expected to move further out of reach. The most popular solutions among experts all ultimately suggest rolling back these rules to increase flexibility and get more projects through the process faster," she continued.

House values are expected to rise 3.6% in 2019, though this is down from previous estimates of 4.2%.

The third-quarter Home Price Expectations Survey analyzed responses from over 100 economists, investment strategists and real estate experts.